DeFi Kingdoms ($JEWEL) Deep Dive

Intro to the P2E game that could take on Axie for the GameFi crown

Welcome to the 92 newly minted Altcoin Evolutionists who have joined us since last post!

📺 Video version coming soon

📝 Short form thread on Twitter

Hi internet frens👋 ,

First off thank you for your continuing support - we hit a small milestone in the weeks between the last post and this; 600 subscribers on YouTube plus we’re also so close to 700 on Twitter (I was surprised to find that I am now being tracked on SocialBlade). Still I want to continue focus on quality over quantity but it’s good to celebrate the small wins.

If you follow me on Twitter you will have seen that I have been experimenting with different content types, frequency of posting and have has my Harmony post translated into Chinese! Thanks to @TechFlowPost for making that happen.

One thing that I enjoyed immensely was my chat to @JKey of SafaryDAO - a fascinating community that connects growth leaders in the Web3 ecosystem (applications are open now). This guy really is thinking deeply about Web3 growth opportunities and how marketers need to change their approach in light of this. You can check out the recording of the twitter space here.

Going deep on individual projects is something that I will be doing more of over the coming weeks, so to kick things off let’s do a deep dive into a project that came onto my radar last week, and caught my attention for a number of reasons.

That project is DeFi Kingdoms: a browser based multichain P2E game with in-built DeFi primitives. It has more users, and similar volume to Axie Infinity but 10x smaller market cap... so what’s holding it back?

Today we’ll jump in and find out

What DeFi Kingdoms?

How it’s tokenomics are built for the long term health of the dApp

Who is behind this game and how well they are executing the vision

Whether it can challenge Axie Infinity for the crown

Cheers,

Greg

DeFi Kingdoms: A sleeping giant slowly taking the GameFi crown from Axie?

Part 1: Introduction

1a) Background and Vision

"DeFi Kingdoms (DFK) is a game, a decentralized exchange (DEX), a liquidity pool (LP) opportunity, and a market of rare utility-driven NFTs, that all plays out seamlessly in the incredibly nostalgic form of fantasy pixel art." ~ DFK docs

It’s vision (in my words) is to become a leading multichain gaming project that empowers its users to make money via built in DeFi protocols.

1b) Problem/Solution

The current state of DeFi is intimidating for noobs (like myself), with many dApps putting the emphasis on the cryptoservices layer as @jmonegro put it:

GameFi in general proposes something which looks a lot more like a traditional Web2 company with a much larger area in value stack for the application layer:

Players interact with the DeFi protocols via an intuitive and fun UI.

1c) GameFi Primer

According to the demographics of blog subscribers most of you will remember Runescape in it’s prime. For those who don’t you, it was one of the big MMORPG’s i.e. you got a character and interacted with the world and other players. You could customise your avatar with weapons, armour and costumes, and also train up skills like mining, fishing and fighting.

I spent hours mining coal and running back and forth to a deposit box to fill it up, then to take it and sell it. This made me in-game wealthy but had no way to get that into the real world. Enter GameFi officially defined as:

GameFi is a fusion of the words game and finance. It refers to play-to-earn blockchain games that offer economic incentives to players. The GameFi ecosystem uses cryptocurrencies, non-fungible tokens (NFTs), and blockchain technology to create a virtual gaming environment.

In practice this means players can earn in game rewards by doing certain tasks which can then be turned into other tokens e.g. Eth, ready to be withdrawn. Hence play to earn.

Back to Runescape instead of mining “coal” which had no real world value, I could have been interacting with a DeFi protocol that gave me yield for my mining action.

In this way, in game actions to gain assets can be turned into tradeable cryptocurrencies at any point meaning gamers time and effort translates directly to their net wealth.

DFK sits in a larger trend moving away from the games of old where initially it was pay to play (e.g. Call of Duty), then free to play (e.g. Runescape) and now GameFi.

So how does DFK do this?

1d) Product

First of all you will need a Hero:

Then you jump into the game to do various quests and actions. You may not realise it but you are actually interacting with decentralised finance protocols throughout the world:

Simple right? Here is what the whole game world could eventually look like:

Eventually you will be able to buy and sell many of the items in the world including the land itself, buildings and resources.

1e) Tokenomics

DFK has two tokens: $JEWEL and $CRYSTAL.

Supply

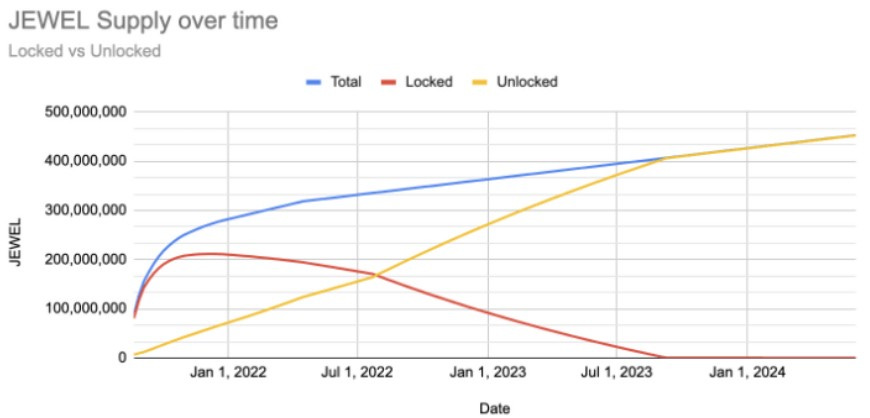

$JEWEL is the original token built on the Harmony blockchain. The JEWEL token has a hard cap of 500,000,000 tokens. 10,000,000 JEWEL tokens were pre-minted and distributed as follows:

The supply curve for JEWEL is as follows:

In the above article @0xDoc says that:

The traditional schedule-dependent unlocking (e.g. locked JEWEL) tends to create a massive snowball effect of withdrawing once unlocking starts because people KNOW the schedule of unlocking dates (e.g. DFK July 2022–2023).

~From 0xDoc DeFira Post

I am not so sure we will see this come to pass as not only is the selling pressure over the course of a year but also as more features/use cases to be added to the game for your tokens such as the revamped Gardens they will have additional locking methods to reduce a market dump. You can read more on this here.

An excellent thread by @Pinehearst_ pointed out that the current token unlock due to mining is levelling out at around 50k per day. But a recently patched (with under 24hrs of down time) exploit was accounting for 50% of that activity as @PetrifyTCG pointed out. This obviously will cause an overestimation in the amount of mining activity so this metric is one to watch closely.

$CRYSTAL is the more recent addition which is native to the DFK chain - this chain is hosted on an Avalanche subnet, making DFK multichain. The CRYSTAL token has a hard cap of 125,000,000 tokens and a pre-mint of 2,500,000 will occur prior to launch to be used in part for initial liquidity with the remainder used to fund a variety of rewards for players.

Demand

In terms of demand for tokens this is driven by transaction fees and in game uses as above. The team set out how the transactions and rewards work in the docs.

The utility of both tokens is explained below:

Since both JEWEL and CRYSTAL can be used to mint new NFTs, the value of the tokens is linked by shared utility. This provides exciting arbitrage opportunities across blockchains and ensures that cross-chain expansion does not lead to a loss of value for older tokens. Future expansions are expected to follow the same strategy.

Additionally, JEWEL is used for gas fees on the DFK Chain, where the gameplay transactions for Crystalvale take place.

~ DFK Docs

1f) Validators

DFK maintains a dashboard to see the current status of Validators, the burn lifetime value:

Part 2: Traction / Metrics

Metrics and traction are the most important part of understanding whether a project is growing (and how fast) or if it is declining.

As one of the top metaverse coins DFK’s fundamentals will need to be strong to mainatin their position.

For GameFi projects the two key metrics we need to look at are (as the name suggests) daily active users playing the game, and Total Value Locked (TVL) a measure of DeFi usage. But we can also look at social growth.

2a) Users

In this part we will take a look at total, active and new users as well as the on-chain volumes of different GameFi tokens and how DFK stacks up.

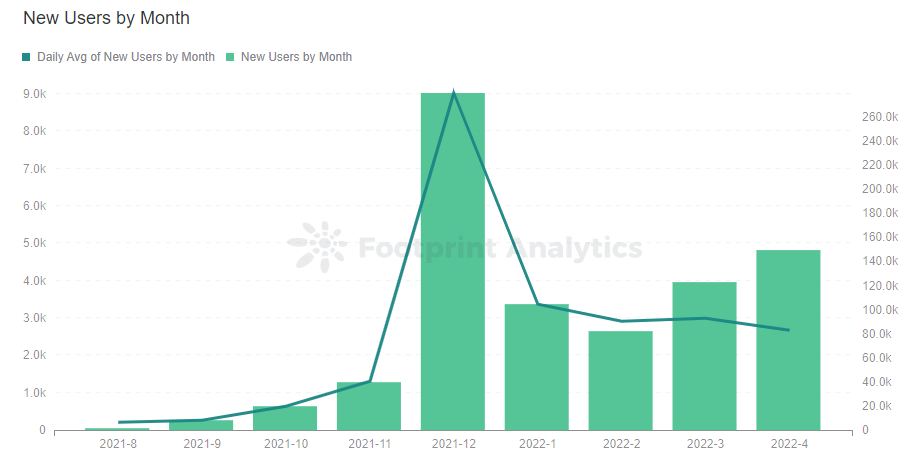

DFK has been growing steadily over time, the addition of the DFK chain (a subnet of Avalanche) has led to a little bump upwards.

Active users had been remaining constant at around 23k but recently took a nosedive - which may have something to do with the price falling.

However there is good news with new user acquisition trending up again after a bit of a dip at the start of the year.

Comparing this to some other chains in the last 30 days DFK has had 200k users, but an order of magnitude higher volume.

Looking at Volume more closely in January DFK was killing it:

Over a longer time frame (Q1-22) we see that DFK was still in the top 10 but hadn’t quite hit the amounts of some of the other chains.

That being said with the volume up +82% from last quarter (QoQ) and continually high daily volumes as per dApp Radar this could change quickly - I will be watching for DeGame’s next update.

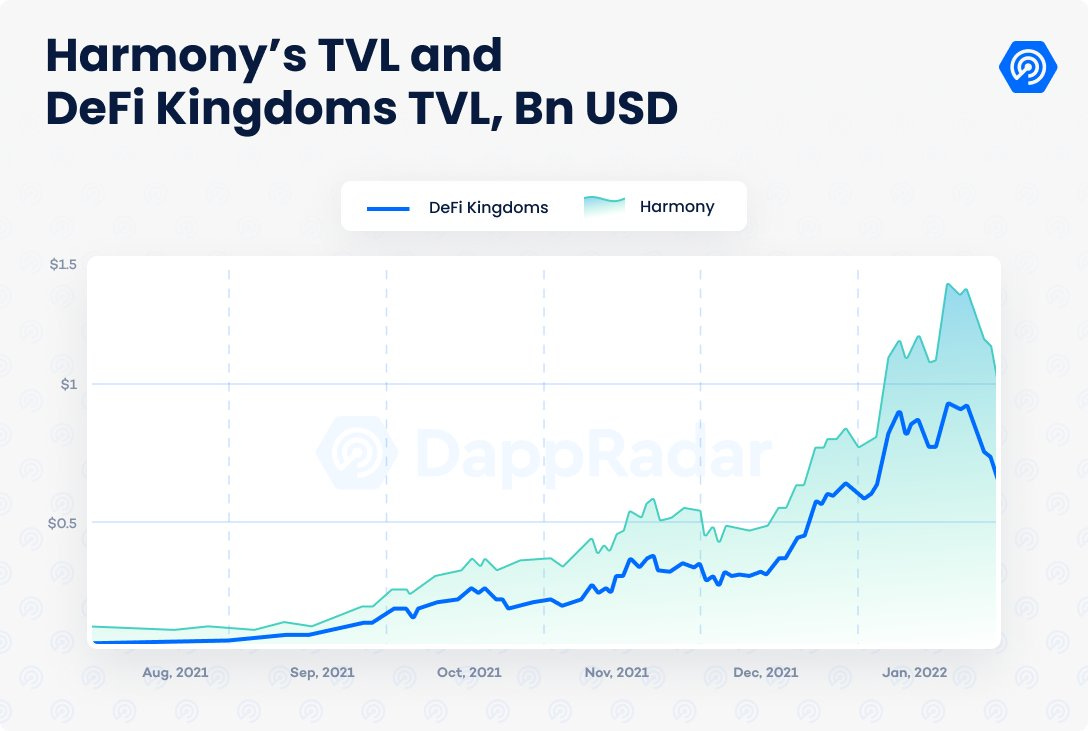

2b) TVL

DFK previously hit a high of $1.26b in TVL, however due to the recent sell off we are now sitting at around the $175m mark, representing 1.75b of locked $ONE tokens.

Looking of January the Harmony ecosystem was heavily reliant on TVL from DFK:

As of today 27 Apr we can see that Tranquil Finance has caught up (or maybe lost less in this case) and now sits ahead of DFK.

2c) Socials

Off-chain data such as socials are also a good way to spot which direction the trend is heading… and here DFK doesn’t disappoint.

Since December there’s been a 30k - 91k growth in Discord, from October 20k-123k Twitter followers… Not bad

Part 3: Challenges to Growth

3a) Engagement

The user retention graph for DFK is pretty typical with early adopters staying much longer but newer entrants dropping off more quickly

Engagement over the long run should improve as the developers iterate on the game and push new features live - but this will be something to keep an eye on.

3b) Competition

A big part of growth will also be dependent on competition. You can read more about the market in DappRadar’s great report in collaboration with the Blockchain Gaming Alliance.

As I am not too deep into the GameFi sector I can’t comment on how the different games stack up but there are some overall trends to looks at.

Funding

First, the lack of funding into Harmony GameFi projects is best illustrated by this chart:

We can clearly see that in Q1 many other chains attracted much greater amounts of funding, all of which will eventually flow in development and marketing dollars in the pursuit of growth.

This doesn’t mean DFK can’t raise money - they have received a $1m grant from the Harmony team to continue building:

But with multiple chains being funded with larger cheques and at higher rates this may make it more of an uphill battle.

Becoming multichain

Harmony had a 2.47% share of gamers in Q1 22 but that is dwarfed by chains like Hive and WAX.

The recently announced integration to Avalanche will bring more users however it too has only a small 0.4% but growing share.

Adding more chains is an option and Do has shown interest… Wen 🌕 DFK?

Multichain is a smart strategy and avalanche is no doubt a popular chain but right for the time being the gains from this will be slow.

This is all relative though as we are only just seeing blockchain come to gaming and the user base will grow many times more than it’s current state as the technology and UX improves.

@Samichpunch did another great article looking at the benefits of going multichain.

Part 4: Team and Governance

The team are an anonymous collective of developers, game designers, creatives, ops and marketing people. You can see the full list here.

They routinely do AMAs most of the time weekly which you can see below:

The team is crushing the execution of their roadmap, rapidly releasing features:

They have also just announced a developer incentive program - which not only will help the community bring ideas to the table, but is also a masterstroke from a recruitment perspective if they require developers in the future…

The community does have some influence over the direction of the team with snapshots being taken for important decisions, and plans for more involvement in the future.

Part 5: Bull and Bear Case

This brings us to the end of our analysis part now we put it all together for the Bear and the Bull Cases for DeFi Kingdoms.

🐂 Bull Case

Avalanche and Harmony are already being touted as gaming chains by their fans, while the current data may show they have a way to catch up, the chains prove to be a great choice for these applications.

The current bleed of TVL is short lived as more game features begin to come online.

The soon to start Kingdom Building program will bare fruit quickly enabling game enthusiasts to develop their ideas and build into the game creating a path for a user generated game - a very exciting idea.

DFK’s team continue to build unhindered by VC’s and bring an excellent gaming experience to market directed and controlled by the community.

🐻 case / headwinds:

There is a huge amount of funding going against the team, this will be a real test of how strong the tokenomics are to both maintain user interest and support development of the platform.

Crossing the chasm to the mainstream has three potential issues:

1. will traditional gamers used to games with massive budgets like the stripped back pixel art?

2. How will the team appeal to mobile - a huge and growing audience, or console gamers?

3. The jump across may also require budgets for advertising and brand awareness initiatives - again this money will have to be generated from the game.

Anon teams are usually a bit of a read flag for me - and something to bear in mind, however they are highly accessible and have been executing well which counteracts a lot of the normal concerns I would have.

Key man risks with the team are hard to assess, but if say Frisky Fox suddenly leaves this could have a big impact on the community.

Part 6: Summary

In this article I set out to understand something which I have not previously looked at in detail: GameFi.

From my perspective DeFi Kingdoms could be a pivotal game in promoting this new paradigm.

Building minimum viable community and bootstrapping a game will not be easy with the likes of Axie Infinity and other big raising games in the works, but the DFK team seems strong and executes extremely well.

Can it in the long run challenge the king of GameFi for it’s crown? I think so.

Further resources

As always I stand on the shoulders of giants with these posts, so here are a few that really pushed this article forward:

@Samichpunch has a vast collection of resources that I would highly recommend reading: https://medium.com/@Samichpunch/index-of-samichpunch-defi-kingdoms-articles-dda9e50327ef

@hansthered is a permabull but well worth reading a lot of his stuff either on twitter or his medium page

@daolectic’s DeFi Kingdoms Breakdown analysis post on Reddit helped clear up some parts for me: https://www.reddit.com/r/CryptoCurrency/comments/rv9lb9/jewel_defi_kingdoms_breakdown_analysis_long_dd/

And finally @coinmonks article by @BoydyGuns https://medium.com/coinmonks/defi-kingdoms-dfk-the-new-ruler-of-gamefi-1d1dd515f6d7

Apart from those here are a list of DFK legends to follow: @FriskyFoxDK, @DFKumberdale, @MrZipper7, @DreamerDFK,@annxliu, @PineCone_Magg, @DfkInvestigator, @nxzreee, @PetrifyTCG

Fin

So that’s it for today, I hope you enjoyed this slightly different post. Let me know what you think in the comments!