Fantom ($FTM): Full Protocol Analysis

Hauntingly good or one that's on it's way to the afterlife... today we find out...

Welcome to the 17 newly minted Altcoin Evolutionists who have joined us since last post!

📺 Don’t like to read? Get the video version of this essay on YouTube

📝 Short form thread on Twitter

Hi internet frens👋 ,

This has been a while in the making. I first came across Fantom when I was looking at valuation metrics for crypto projects. That lead me to @j0hnwang’s excellent Fantom Thesis, which not only showed how strong Fantom was shaping up to be but also prompted me to start writing this substack and doing the mega threads on Twitter which imo have helped me hit that 1000 follower mark (so thanks John!).

John’s thread was a great example of balanced writing. I am always on the look out for different perspectives and put these views in my essays to try to draw out both the good and bad things to give a well rounded view. Crytpo Twitter in particular can be both an echo chamber and the team that shouts the loudest competition… Something which I see as an unintended (but perhaps forseeable) consequence of having people stake their money and reputation by backing a particular coin…

When you are doing your own research be mindful of the incentives at play, as Charlie Munger said “Show me the incentive and I will show you the outcome”. (Ironically I was just about to post this and this thread popped up even quoting the same quote!) That’s as true for this essay as any others :)

On that note a disclaimer: I don’t hold any Fantom but am planning to initiate a position in the next couple of weeks.

Anyway treading back from the meta narratives to the task at hand, let’s jump in and see if we should consider Fantom as an Alt-L1 potential…

A little intro to Fantom

Fantom is a lesser known L1 with a surprisingly strong offering. With it’s focus on DeFi it has amassed a large amount of TVL in the ecosystem which, not only makes it the 3rd biggest chain in TVL, but using a simple metric of Market Cap vs TVL makes Fantom’s $FTM token the most undervalued asset of all L1s.

However, the recent revelations about @danielesesta’s projects shook the DeFi world and TVL bled out of many of the leading protocols. Given the star of the ecosystem @AndreCronjeTech is working closely with Daniel on the flagship DeFi project for Fantom, it could get rocky (pardon the pun - those who know know).

Still the stats are looking promising for FTM on the whole with strong growth in users, TVL and developers.

Today we’ll jump into each of the key areas of Fantom covering:

The origins of the protocol

The problem it is trying to tackle and what solutions it is bringing to market

Who are the investors and how do the Tokenomics work

How resistant the network is to attack?

What the developer experience is like

User growth and utility

Team and Future Governance

We’ll then round off with a bull and a bear case for FTM and ecosystem.

Let’s gooo….

L1 Business Model Analysis (BMA) Framework

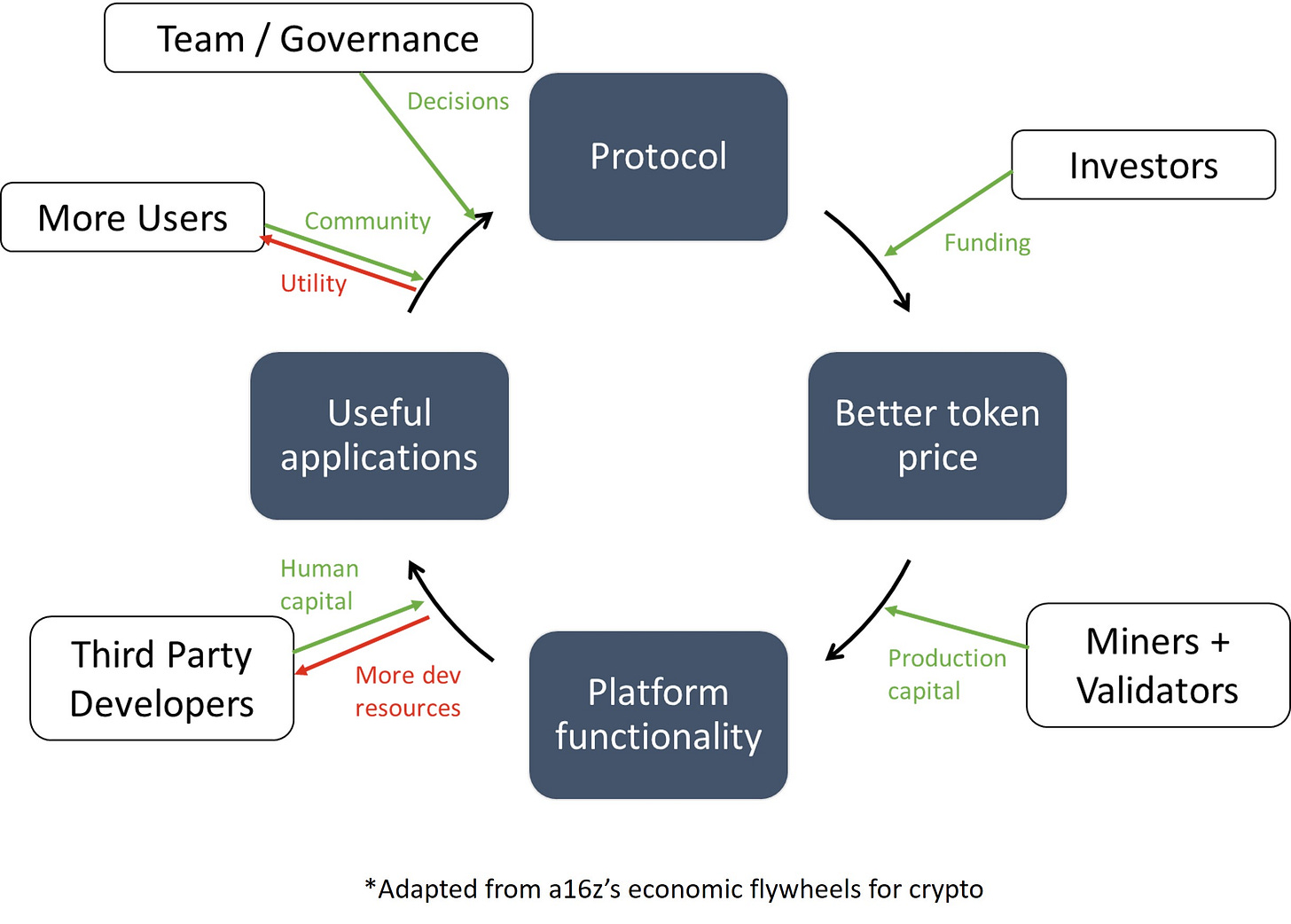

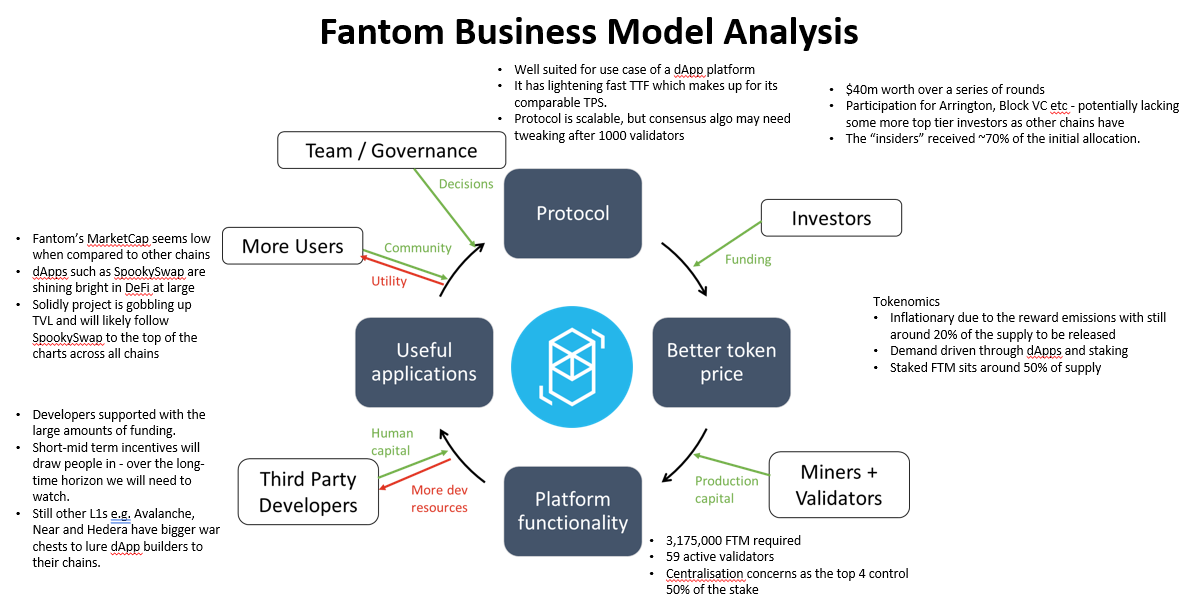

As a quick reminder on how we do these analyses; for any L1 technology I adapted a16z’s economic flywheels for crypto framework as shown below:

In principle, what happens here is the team designs, the protocol they input the decisions and stuff, the protocol attracts funding via investors and they give liquidity to the network, which gives a protocol its initial token price. Miners and validators are then attracted to supporting the network because of incentives (tokenomics) which improves the platform functionality because we're now validating blocks.

We now have a working blockchain with nothing being built on it so we turn to developers and try to incentivize them (via resources, grants etc) to build on the blockchain. They put human capital into building DApps and other useful stuff that people want to use attracting users onto the blockchain. These users form the community and eventually help govern the system.

N.B. This analysis will be slightly different format as we have already had a couple of excellent mega tweets on Fantom which I’ll reference throughout, so as to not to repeat what’s already been done by the likes of @Route2FI, @j0hnwang, @JackNiewold, @shivsakhuja and others, I will add commentary to some of their tweets and summarise where appropriate. Where we have statistics and quoted figures I will update them for today’s prices - and draw comparisons!

Fantom ($FTM): Should we pay attention to this spooky L1?

Part 1: The Protocol

1a) Background

Fantom was founded in 2018 with the goal to solve some of Ethereum’s scaling issues, which were very apparent due to the explosive growth in crypto kitties.

Fantom initially set it’s sights on expanding beyond just blockchain infra into the world of smart cities.

Fast forward a few years however it doesn’t look like the partnership came to fruition with Dubai, instead finding partners in Afghanistan…

This was pre-takeover by the Taliban of course, so I think it’s safe to assume this is on the backburner for now.

The direction Fantom is now taking is to provide:

A fast, high-throughput open-source smart contract platform for digital assets and dApps.

~ Fantom Foundation

The platform is for designed developers to build their dApps on fully customisable blockchains (similar to Cosmos’ zones/hubs, XRP’s sidechains etc). This makes Fantom a network of blockchains rather than just a monolithic chain.

With this in mind we should pay particular attention to the developer uptake on the network (something we look at further down).

1b) Problem/Solution

When new L1s come about it is usually trying to solve issues that plague other chains due to design choices, this is known as the Blockchain Trilemma.

Coined by Vitalik Buterin, The Blockchain Trilemma addresses the challenges developers face in creating a blockchain that is scalable, decentralized and secure — without compromising on any facet.

While Fantom is no exception here as it makes it’s own trade offs, it does have a couple of key features that sets it apart:

1c) Do you like DAGs?

As Jack mentions Fantom is based on a DAG system (you can read a full explanation of the system in relatively plain English here).

The Defiant summed up the advantages of DAGs:

Although the underlying mechanics and application of DAGs are quite new to cryptocurrencies, there are several advantages, chiefly being greater speed, no requirement for mining, little to no transaction fees, and no scalability issues.

As for consensus, a full explanation can be read on Fantom’s Blog but for our purposes the Defiant again saves me having to go too deep:

[Lachesis] allows consistently high-throughput, fast finality, and bank-grade security. Developers can also use Lachesis to build applications without creating their own networking layer and leverage its core advantages, chiefly being an asynchronous design, leaderless environment, Byzantine Fault-Tolerant, and able to confirm transactions in 1-2 seconds.

While the FDN claims it can scale Lachesis into a decentralised network, others disagree:

1d) Transactions per second (TPS)

Fantom’s core belief is things need to be fast. However we are currently only achieving 15 TPS (as per fantoms official block explorer).

This does seem to counteract one of Fantom’s main draws of being a platform built for speed. The difference in claimed speed vs reality isn’t unusual as @j0hnwang points out:

1e) Time to Finality

More important than TPS is TTF, which in this case score’s Fantom some points.

Fantom's time to finality is about a second, versus 13 seconds on Solana and more than a minute on Ethereum.

~ The Motley Fool

Or for the more technical:

Fantom’s distinguishing feature is its deterministic finality: as soon as a block is written to the chain, it is final and irreversible. In Fantom, a transaction just needs a single confirmation.

Fantom’s speed advantage derives from its consensus algorithm that requires ⅔+1 of the total validating power across nodes to confirm a transaction. As soon as a supermajority of nodes validates a transaction, it is considered to be a “root.”

Ethereum by comparison can take up to 3 minutes to achieve finality. Therefore while Fantom is slow in TPS for now, it reaches finality very quickly which, taking the whole end to end process of writing to a blockchain is still a strong tick in Fantom’s box.

1e) Compatibility with other chains

The final key part of the puzzle for Fantom is interoperability. Unlike Luna (see previous post) Fantom built it’s own chain from the ground up, but it took key decisions to ensure it was compatible with the Cosmos SDK, as well as EVM which opens up Ethereum, L2’s e.g. Polygon / Arbitrum / Optimism, Avalanche, Binance Smart Chain and more.

Part 1 Summary

After a couple of false starts in terms of direction, Fantom is pursuing a similar goal to many other L1s - becoming a platform that solves issues with scaling that hamstrings Ethereum (read on to find out how it is doing). It has lightening fast TTF which makes up for its comparable TPS.

As far as I understood it the DAG part of the protocol is fully scalable however the consensus model may need tweaks to scale across >1000 validators. This may or may not be an issue in the long run as the network could be performant despite having fewer validators, however we would then get into centralization issues - something to monitor then if you are in it for the long haul!

On the whole, the protocol and choice of consensus is a good fit to enable the vision. So filling in our BMA:

Part 2: Investors, Tokenomics and Validators

2a) Investment Rounds

In terms of funding, Fantom is no slouch having raised a combined $40m worth over a series of rounds:

2b) Who backed Fantom?

The investors are quite varied, although afaik could be considered the 2nd tier VC’s (massive caveat in that I have not had time to look at each one of these, the only name I recognise was Arrington & JLab)

2c) Investor Token Allocation

The allocation is heavier than a lot of others in favour of “insiders” i.e. founders + investors with 70% of tokens in their pockets.

2d) Tokenomics (Supply)

The total distribution of FTM tokens is 3.175 billion. 2.1 billion FTM tokens are actively circulating. The remaining are kept as staking rewards for the FTM holders. Tips are based on governance decisions.

Since the above quote was written another 0.45b FTM tokens have come on the market making the circulating supply 2.55b. This means that their is still 0.625b tokens that will need to come onto the market (nearly 20% of the supply).

The total liquid supply of Fantom including the planned emissions looks as follows:

2e) Tokenomics (Demand)

Demand comes from the apps, which typically rely on FTM lockups etc., and staking. Currently about half the available supply is staked, and, as we can see, the amount staked is up over 10.54% in the last 30 days:

2f) Validators and Miners

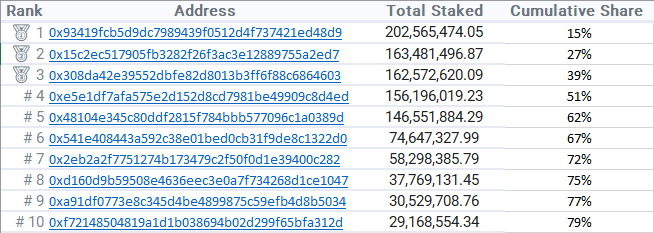

Anyone can set up a validating node by staking a minimum of 3,175,000 native FTM tokens… which may be a reason why there are currently only 59 active validators:

2g) Centralisation concerns

One of the bigger issues with Fantom is it’s level of centralisation. In March 2021 this issue was laid bare and the whole network went down:

This situation doesn’t seem to have changed much when we calculate the share of power of the network today we are still seeing the top 4 controlling >50% of the network:

Part 2: Investors, Tokenomics and Validators Summary

In summary then, Fantom has raised a sizeable amount of funding ~$40m from some notable investors but lacks those top tier firms backing them which other chains have.

The tokenomics are inflationary due to the reward emissions with still around 20% of the supply to be released. Demand driven through dApps and staking - staked FTM sits around 50% of supply.

There are issues with centralisation top 4 controlling >50% of the network, which may not be solved due to scaling potential of the Lachesis Consensus although even with 1k validators instead of 59 the concentration of power is sure to be spread out more.

Part 3 Developers

3a) Developer Growth

There is a wealth of information for developers that has been created via the Fantom Foundation, which has lead to explosive growth in the number of developers working on Fantom related project.

Electric Capital Developer Report (2021) shows Fantom is growing fast in the number of developers, with 4x as many as in 2020. Only Harmony, Terra and ICP are also in this bracket.

Not only that but it is also one of the fastest growing ecosystems with more than 50 developers both in full time and part time devs:

The thing to remember with % gains of course is that Fantom started from a lower overall number so the absolute number of developers gained may still be lagging. But the fact that it is in top 10 for both part time and full time growth is a great sign.

3b) Grant program

The jump in developer activity may be in part attributed to the whopping grant program of $792m which ranks it in the higher end of the spectrum as we can see from the block’s research report:

The funds are mostly geared towards liquidity mining on DeFi protocols rather than say grants to take punts on dApp builders as this post lays out.

Still other L1s e.g. Avalanche, Near and Hedera have bigger war chests to lure dApp builders to their chains.

Part 3 Developer Experience Summary

The growing appetite to build on Fantom will be supported with the large amounts of funding on offer, meaning this ecosystem is set to fly as more developers build useful applications. Competition will be fierce with other chains offering similarly sized incentives.

While the incentive program is unlikely to run out in the short-mid term over the long time horizon we will need to watch the winding down of these programs carefully as they may have a detrimental effect across all stats.

Part 4: dApps and Usage

4a) Onchain analysis

4a.i) Unique Addresses

Kicking things off in our on chcian data we have the following graph, showing us Fantom is now at the 2.28M unique addresses mark plus it gives us an indication in the growth of unique addresses on chain:

Unsurprisingly this still lags far behind Ethereum’s 189.26M addresses (as per EtherScan.io). but the growth is faster.

Other chain unique address counts are also higher than Fantom: BNB 6.79M, Cardano 3.45M, Polygon 138.18M, and Luna 3.62M. The notable exception is Avalanche at 2.11M.

@RobotDefi Just covered this too:

4a.ii) Daily transactions

One big revelations over the passed few days is Fantom surpassed ETH in terms of daily transactions:

We’re currently reading off about 1.18M transactions as per the FTM Block explorer

Versus Ethereum’s 1.16M:

The daily transaction for other chains are as follows: BNB (5.35M), Polygon (3.13M), Avalanche (1.03M), FTM has already eclipsed both Solana (133.82K), Cardano (66.34K).

This is great news for Fantom as it will help form the narrative that it is here to stay and challenge Ethereum for dominance.

4a.iii) TVL - Undervaluing Fantom

I put this section here rather than in offchain as although we look at MCap (off chain), we also use TVL - which is on chain…

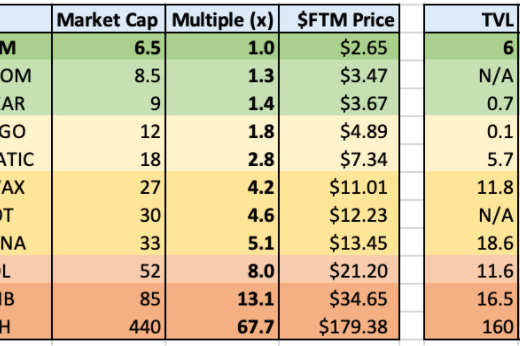

Jack Niewold pointed out that Fantom is not some random chain with no activity but has a meaningful amount of TVL:

Compared to today when Fantom is looking even more undervalued on DeFiLlama…

Jack then pulls out the data for a table in the reply, which I have then updated for today’s prices:

We have had a nearly 2x improvement in the “If all things were equal column”… what is the cause of this?

Well as we can see all the MCap/TVL values are down, however has Fantom had a massive influx in terms of TVL going from $4.86b in December 21 to $14.62b in March 22; a roughly ~3x improvement!

This has meant Fantoms MCap to TVL ratio is now a meagre 0.344... And @j0hnwang thought a ratio of 1.2 was crazy…

I would be remiss to not mention the fact that MCap/TVL only looks at two dimensions of an ecosystem - so we would want to consider a much wider range of issues to truly compare the various ecosystems (which is what we are doing in the rest of this essay).

4a.iv) How does this stack up over time against other chains?

Here are the top 15 chains in terms of TVL as of today:

The Block wrote an excellent end of year round up 2022 Digital Asset Outlook that can be found here. They compared a selection of L1s:

By normalising growth to a 0 point we can see how the chains have grown relative to their starting size. Avalanche leads the way with their tremendously successful Avalanche rush program, followed closely by Harmony.

Algorand, Solana and Fantom have all had similar uptakes in TVL when this report was written. However given what we learned above about the massive influx into Fantom in both Jan & Feb 2022, I think we can assume there will be a nice spike upwards in next years report.

4a.v) What Fantom dApps are attracting TVL?

Drilling down we can split out the TVL by project and see that the majority of the TVL came from Geist’s launch however other DeFi protocols are catching up fast with SpookySwap and Tomb finance trending higher quickly:

We will look at the dApp ecosystem further below but I went deeper on several projects in the ecosystem in my last post which you can find here:

4b) Off Chain Metrics - Socials

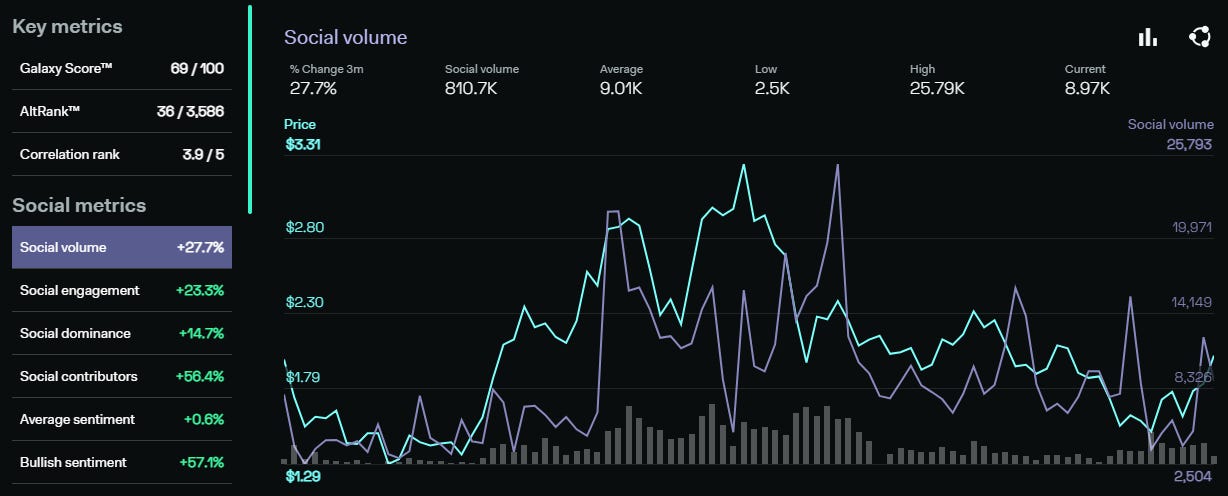

Fantom has an avid and loyal user base which has been growing as the chain has gained popularity. We can see this in increasing volumes of social activity as tracked by LunarCrush:

4c) dApp Ecosystem

The number of dApps is growing with dAppRadar reporting 144 different dApps. Cardano and Solana lag behind this number but the other chains have more.

The following infographic captures the variety of the ecosystem:

4d) dApp Highlight

SpookySwap vs SpiritSwap is an interest case of two AMMs tussling for domination on one chain.

So far it seems SpookySwap is winning the TVL and Volume battle…

BUT WAIT…

Solidly DEX is rapidly claiming TVL:

The launch of Solidly has caused some network issues with the recent congestion on the chain:

Time will tell who will reign supreme on Fantom, but for now SpookySwap seem to be pulling away from all DEXs with increasing numbers of users and volume.

In my previous post I claimed SpookySwap was undervalued… the stats are still leading me to this conclusion…

Summary of Part 4: dApps and Usage

This table shows a summary of all the stats used in this part plus comparison numbers for other chains:

Fantom ranks pretty favourably in all areas… the MarketCap does seem at the much lower end of the spectrum given both the on and off chain stats.

The SpookySwap DEX is punching above its weight capturing users, volume and fees, but Solidly is hot on it’s heels and clogging up the network as a result of it’s massive pull.

Part 5: Team

The original founder Dr. Ahn Byung Ik, seems to have had an acrimonious dispute with the direction of the project at some point, leaving Fantom and scrubbing all mentions of it from his LinkedIn (as per CoinBureau).

The original CIO Michael Kong, previously working at a blockchain incubator, stepped up to fill the role of CEO along with a strong team of individuals including DeFi superstar Andre Cronje, previously founder of Yearn Finance.

Team issues…

One of the core strengths mentioned in @j0hnwangs epic thread was the Andrej Cronje x Daniele Sestagalli…

As far as I understand it Dani had a huge loyal following. But for another project called Wonderland $TIME, that Dani was lead on it was found out that the protocol’s treasury head, 0xSifu, was Michael Patryn, a convicted felon. This is a big problem and $TIME unceremoniously dumped, however to double down Dani admitted he knew about it… So yeah… Make of that what you will…

Anyway Andrej tweeted out (his account recently got blocked) that he is still going to continue the work with Daniele cautiously. It doesn’t seem as though this episode negatively affected the launch of Solidly as it continues to gain traction.

Governance

The initial Fantom team transitioned into a foundation to steward the development of the chain early on in the project. But it wasn’t until Jan 2021 that we saw the proposal for an onchain governance system which would direct the protocols development (as detailed here).

Part 5: Team and Governance Summary

So finally the team is reasonably strong although there are a few question marks around elements. It’s good to remember they hold a fair amount of the allocated tokens at this point too, so adjust accordingly.

Onchain governance seems to be the future and Fantom is well positioned having implemented and currently using their version to good effect.

So here it is our completed Business Model Analysis

Part 6: Closing Thoughts

This brings us to the end of our analysis part now we put it all together for the Bear and the Bull Cases for Fantom.

🐂 Bull Case

The bull case for Fantom is as follows:

It’s ability to absorb TVL from other chains continues to win over new users and developers

It eventually becomes the chain of choice for DeFi development

Plus there’s no denying that Fantom is still a relatively small chain with strong onchain metrics which does give it potential to produce outsized returns:

Recalculating the above table for today:

The “What would the FTM price be if…” being lower doesn’t show a bad thing necessarily, it actually shows how much better Fantom has performed vs the other L1s (with the exception of Luna which has gone on a massive run).

🐻 case / headwinds

That’s not to say Fantom doesn’t face some headwinds in the form of stiff competition… This table from earlier does demonstrate the uphill battle they have against the likes of Polygon, Binance, Avalanche, Luna and of course Eth.

In addition we have the issues as mentioned earlier:

Issues with scaling Lachesis could require tweaking the algorithm

Still 20% of the supply to be released

And that’s a wrap!

Conclusions

Overall, Fantom ($FTM) has a strong start in the world and if it can continue to compound its success I have no doubt it will hit the top 10 in short order.

As always DYOR this is not investment advice, also I might have missed stuff that is a key technology thing that you may understand better than I do.

Hope you enjoyed this deep dive into Fantom, I will be talking about it a lot more on Twitter. So if you follow me there @0xGregH that will give you the latest.

If you liked this content, please give us a share and tag me!

Video version:

Bonus: Resources…

Fantom Protocol legends to follow:

@FTMAlerts, @fantom_daily, @crypto_klay, @DoubleyouW3, @j0hnwang, @AndreCronjeTech, @Route2FI,@JackNiewold, @shivsakhuja, @Coin98Analytics, @AvgJoesCrypto and many more

Best of the Mega-Threads in chronological order: