Fantom ($FTM) Projects to watch for 2022

The ecosystem with more TVL than market cap continues to provide new use cases in DeFi

Welcome to the 134 newly Altcoin Evolutionists who have joined us since last issue!

📺 Don’t like to read? Get the video version of this essay on YouTube

📝 Short form thread on Twitter

Hi internet frens👋 ,

Fantom is an ecosystem that broke onto the scene in 2021 and as of writing is up 11976% since the beginning of last year - not bad returns.

With the guidance of Yearn Finance founder Andre Cronje (a huge deal in blockchain), the game for this year is to proliferate the ecosystem and technology through building great applications.

Today we’re taking a look at some of these dApps; what they are, what traction they have achieved and why they are important to the ecosystem.

In part 2 will take a deep dive into the protocol ecosystem as a whole and look at everything from product market fit to 3rd party developer resources… so stay tuned…

And without further ado then let’s do this…

Fantom ($FTM) Ecosystem Analysis

Intro

FANTOM is a DAG-based Smart Contract platform that tries to address the scalability concerns that have plagued distributed ledger systems. The goal is to encourage the creation of dApps that allow all users to benefit from rapid transactions and low transaction fees.

The Fantom Ecosystem market cap today is $211 Billion, a -0.7% change in the last 24 hours.

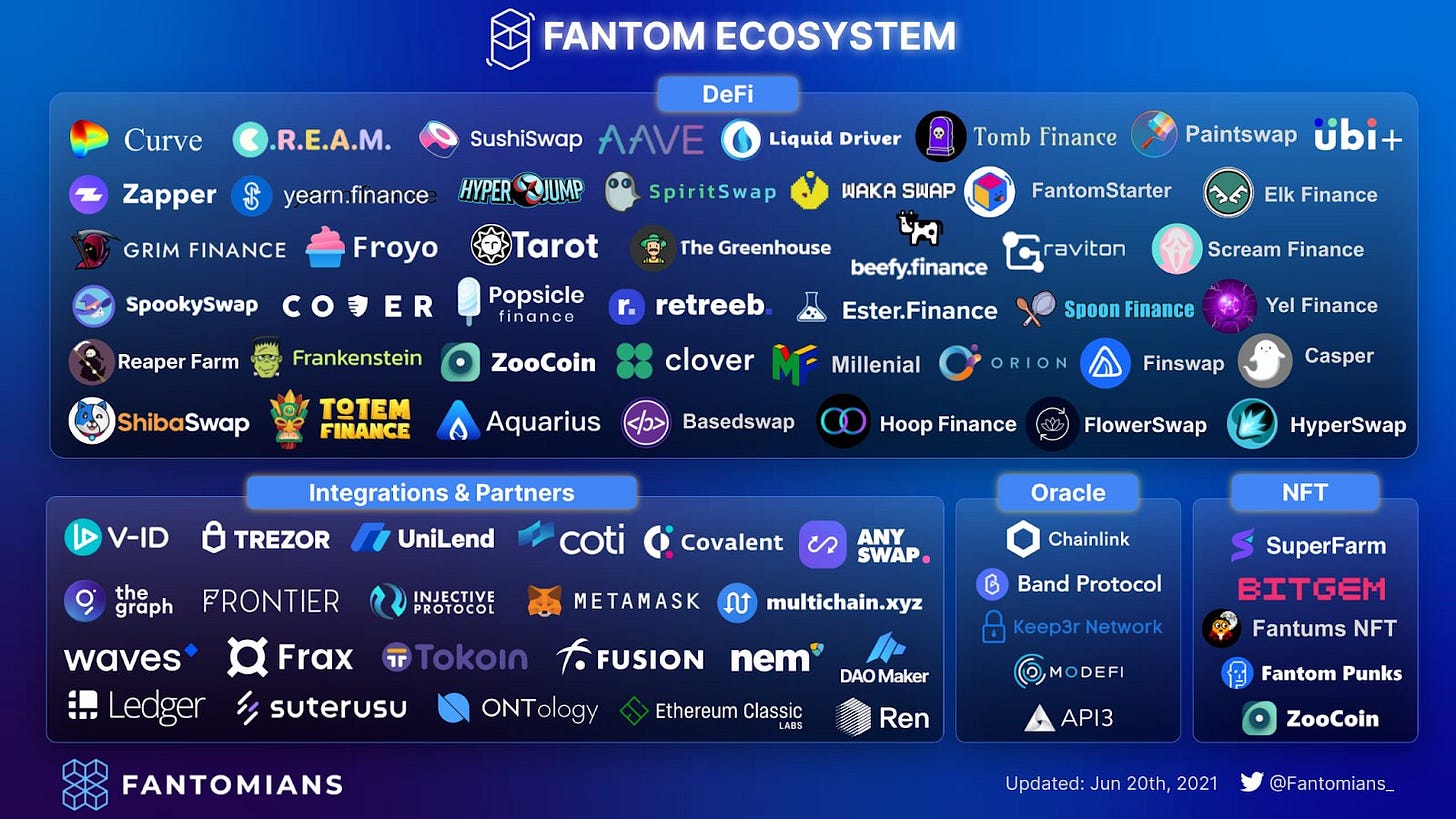

The growth in the ecosystem cannot be understated, as a quick check lets look at the Fantom ecosystem map 6 months apart (thanks to @fantomians_ for these!)

Let's take a look at a few of them making real progress and some that show promise.

Geist Finance $GEIST

a) What is it?

With a TVL of $1.49b according to DeFiLlama Geist is in the number 2 spot in terms of Fantom Ecosystem rankings, but is first in our list as it’s the highest Fantom only chain.

It is a borrowing and lending protocol that is pretty much identical to Aave.

A key differentiation however is, as Geist puts it:

GEIST is the native token within the Geist protocol. GEIST is a revenue sharing token, not a governance token. The protocol has no concept of governance or ownership, and also no treasury. Instead, 50% of all revenue generated through lending is distributed directly to users who stake GEIST.

GEIST has a total supply of 1,000,000,000.

40% given as incentives for lenders and borrowers, released over a period of five years

20% given as incentives for GEIST/FTM liquidity providers, released over a period of five years

20% allocated for airdrops and incentives to related DeFi communities, happening over a minimum of one year (including Curve gauge bribes and others listed below)

20% to the team, released linearly over one year

The initial reward Tokenomics of GEIST are geared to incentivize borrowing with a weighting of 2:1 in favor of borrowers (who generate revenue for the protocol).

The platform fees work in the following way:

One think to note is that there is a difference between locking and staking GEIST as this infographic shows:

b) Key Statistics

As above Geist has a TVL of $1.49b according to DeFi Llama which makes it one of the most valuable projects in the ecosystem.

Geist’s dashboard shows the locked vs staked totals as follows:

c) Importance to the ecosystem

Geist’s launch played a large part in attracting new money into the ecosystem. While they offered very generous GEIST token rewards IMO the airdrop to holders of Aave and stkAave moved the needle the most - leading to a 36% jump on launch for the FTM token.

As stated above Geist has ~$1.4-1.5b in TVL for a market cap of only $49m! Plus as the borrowing part of GEIST of this will generate fees, which according to it’s dashboard is an estimated $43m to date.

I did some more data crunching on your behalf…

So we’re on track for $1.2m this month but we’ll want to see where these fees end up once all the rewards have been used… The trend is slightly alarming but to be expected. We can then reassess when we have reached a steady state.

Spooky Swap (@SpookySwap)

a) What is it?

SpookySwap is an AMM (Automated Market-Making) DEX; self described as a:

Community-driven, trader-focused DEX and DeFi Hub powered by $FTM with governance by $BOO

~@SpookySwap

As above the token of SpookySwap is $BOO which is used in governance votes, for staking or as collateral on other protocols.

There are four available products: Swap, Liquidity, Liquidity Farms and Single Stake Pools.

Swaps - allows trading of one token to another

Liquidity - Similar to other DEXs users can add liquidity and earn LP tokens which can be staked to earn BOO

Liquidity Farm - where LPs stake their tokens to earn BOOs

Single Stake Pools - only one type of token is needed to stake. By staking BOO you would get receive xBOO tokens as proof, which you can stake in partner pools to earn other tokens

BOO Token Use Case

On the SpookySwap platform, users can take advantage of BOO tokens in multiple ways, including:

Providing Liquidity in pools allows users to earn the swapping fees from the pairs.

Farm: Farming is a popular feature on many DEXs. It is the place to stake spLP (Spooky Liquidity Pair Tokens) to earn BOO tokens. Those farms motivate users to provide liquidity to SpookySwap’s pools and help manage Impermanent Loss risk.

The BOO token is the governance token of SpookySwap for voting on changes to the protocol. That feature contributes to making SpookySwap decentralized.

By depositing BOO in the buyback BOO pool, you get xBOO in return as the share of your stake. xBOO is just like BOO, but you can stake xBOO to earn other tokens in the pool list.

BOO tokens are also used to participate in IDO sales on FTMpad - the first IDO platform on Fantom Opera Chain. As a result, the BOO token is tied to FTMpad’s stake.

Tokenomics

The fee structure of SpookySwap are as follows:

0.2% trading fee (0.22% for limit orders), of which 0.17% is returned to liquidity pools as a reward for liquidity providers and 0.03% to xBOO Stakers.

Liquidity providers earn 0.2% swapping fees from the pairs they've provided liquidity for.

Driving demand is mostly the staking and yield earning options available to token holders through the various products.

The initial allocation is as shown:

It is worth noting that the emissions are already slowing from their height in 2021

b) Key Statistics

SpookySwap has been really cracking along with both TVL and Volume increasing dramatically since H2 21:

c) Importance to the ecosystem

Currently, SpookySwap is steadily advancing to accumulate as much TVL as possible. As a result, there are multiple less competitive projects on Fantom being dominated.

Here are some key points from Coin98 Insights for investment considerations:

Being audited by Certik, SpookySwap gains trust from DeFi users. To emphasize, not every project is audited by major blockchain security companies, especially Certik.

To compete with other DEXs, SpookySwap has an edge that is Single Stake Pools. That means you can stake BOO tokens to earn other tokens. Thus, the BOO token facilitates users to accumulate other tokens on Fantom Opera Chain.

Users can bridge tokens from Ethereum or BSC to Fantom with the SpookySwap bridge. This bridging feature will bring more and more liquidity and users to SpookySwap.

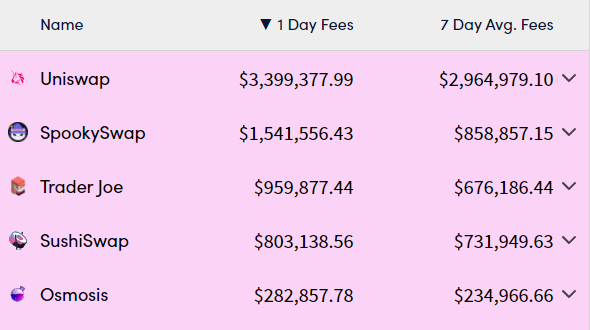

From what I can tell Spooky Swap is undervalued as a DEX. As Miles put it:

This is even more important to bear in mind when you look at fees:

So definitely one to watch imo (NFA)

Solidly (@solidlyexchange)

a) What is it?

SpookySwap faces a new competitor in the form of Solidly; the latest AMM for Fantom, 100% decentralised from day 1 and controlled by protocols within the ecosystem.

Solidly will function like Convex & Curve in that you lock up tokens in return for a rewards which grow higher over time PLUS ponzinomic mechanics similar to OlympusDAO’s pioneering method.

There are two key technical differentiators you need to know about

Locked tokens become tradeable NFTs, which makes these cash flowing assets tradable

Rather than OlympusDAO’s approach of providing liquidity to other protocols (AFAIK) the approach here is to make the top 25 protocols on Fantom into liquidity providers for the protocol. (This is a bit of a weird one so definitely DYOR and come to your own understanding)

Jack Niewold does an excellent thread looking into Solidly, previously called Ve(3,3), a lot more than I could:

b) Key Statistics

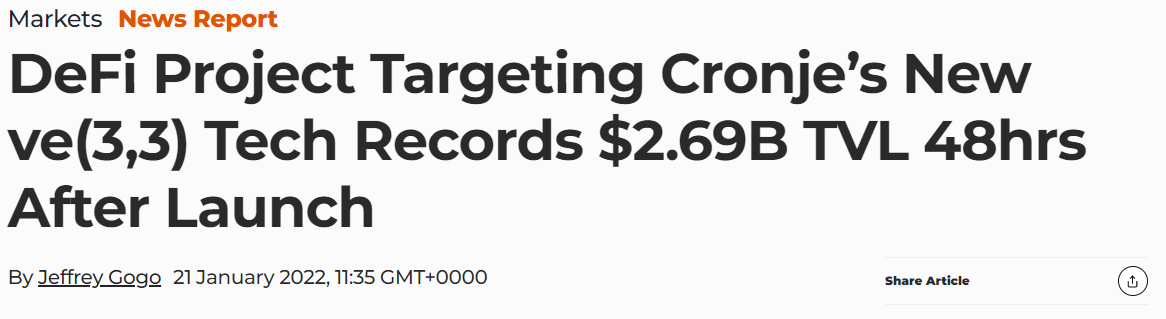

While solidly has just launched:

We've seen early signs of the hype it has attracted

Also as we can see from this graph courtesy of DeFiLlama the anticipation of the Solidly launch caused the TVL within the Fantom ecosystem to swell by almost 3x since the start of the year.

c) Importance to the ecosystem

There are two main reasons this project is massively important to Fantom…

Firstly, Andre Cronje is a bit of a big deal. Well respected and followed he is a legend in the crypto space he was the founder of yearn finance which is one of the prominent DeFi applications on Ethereum. His interest in Fantom is sure to drive other developers to the chain.

Secondly, traders looking to get in and secure some of the tokens have already increased the TVL of the Fantom ecosystem as a whole. If the project proves to be a success, it will pull more capital into the ecosystem fuelling its growth and the value of the top 25 projects that have a stake in Solidly are likely to begin trading at a premium.

Want more on Solidly?

Giga brain stuff: https://www.reddit.com/r/FantomFoundation/comments/s97i76/solidly_ve33_gaming_the_airdrop/

&& more for Jack..

Tomb ($TOMB)

a) What is it?

The first CROSSCHAIN Algorithmic token $TOMB on $FTM $MATIC $AVAX pegged to $FTM

~ @tombfinance

Tomb is the first algorithmic token on Fantom. It follows the price of an asset (FTM in this case) using a protocol that will push the price up or down to stay close to the peg target (similar to Terra/LUNA).

Tomb.finance has three tokens:

Tomb ($TOMB) - This is the token pegged to Fantom, you can think of it as a $FTMT similar to stablecoins e.g. UST

Tomb Shares ($TSHARE) - TOMB and distributes new mints proportionally to all staked TSHARE holders, and also get votes in governance proposals

Tomb Bonds ($TBOND) - When contracting users can buy TOMB Bonds (TBONDs) which helps maintain the peg

b) Key Statistics

Tomb has been doing very well attracting ~$830m in TVL as shown by their homepage:

c) Importance to the ecosystem

If you are thinking wtf, what’s the point in a peg to FTM… well good question…

Blockchains that focus on utility have consistently run into problems where HODLers of the tokens are mostly sitting in them, waiting for their tendies, rather than participate in the system. This can lead to issues with liquidity in the system.

Tomb solves this issue by allowing HODLers lock up their tokens creating a 1:1 asset that can be redeemed at any time.

This means that users can transact freely in the “mirrored” asset rather than using the base asset (I’ve looked at similar ideas here in my Terra projects analysis).

Its not been all plain sailing of course with a rekt.news/tomb-finance-rekt/ covering the hack from September last year.

At the end of the day, liquidity is the lifeblood of DeFi which is why Tomb came in on my list today.

Honorable mentions

There’s only so much time I can spend each week(ish) looking at various bits so here are the top projects I didn’t get round to in this review:

Scream (@screamdotsh) - a highly scalable decentralized lending protocol powered by Fantom. Number 3 on DeFiLlama’s TVL rankings at $1.32b

Paint Swap (@paint_swap) - PaintSwap is an open NFT marketplace supporting all NFTs. As well as a decentralized exchange and farming platform on Fantom!

Spiritswap (@Spirit_Swap) - Another AMM, less used than SpookySwap above with only $284.24m in TVL, however it seems to be rolling out features quickly so one to watch in the future

LiquidDriver (@LiquidDriver) - First Yield Aggregator offering Liquidity-as-a-Service on Fantom.

Iron Bank ($IB) @ibdotxyz & Morpheus Swap ($PILLS) @MorpheusSwap - A decentralized protocol to protocol lending platform and DEX respectovely, these two were called out by Jack as ones to watch for the Solidly launch however it came with the warning that details of $ROCK distribution wasn’t clear so DYOR.

Summary

This has been a look at Top Fantom ($FTM) Projects with traction to watch for 2022, as I hope you can see the ecosystem is fast growing with huge potential

I will be talking about it a lot more on Twitter. So if you follow me there @0xGregH that will give you the latest.

This forms part 1 of my Fantom deep dive; subscribe/follow/watch this space for part 2 coming next week! If you liked this content, please give us a share and tag me! Subscribe below for more content: