Harmony ($ONE): Full protocol analysis

L1 or L2 you decide but this chain has some strong growth that are worth exploring

Welcome to the 17 newly minted Altcoin Evolutionists who have joined us since last post!

📺 Get the video version of this essay on YouTube

📝 Short form thread on Twitter

Hi internet frens👋 ,

Holidays over and I am back to writing content!

I’m constantly on the look out for new L1s* that offer a significant challenge to Ethereum as I believe that this battle will define the multichain future and provide outsized returns to investors who place their bets wisely.

Harmony ($ONE) is one such chain. It caught my eye when The Block published it’s 2022 report and Harmony featured in a number of places. Therefore today we go digging on what Harmony is and how it is looking to stand out from a crowded field in the Alt-L1* space.

*Harmony is referred as both an L1 and L2 by different people - so I stick to calling it an L1.

Cheers,

Greg

L1 Business Model Analysis (BMA) Framework

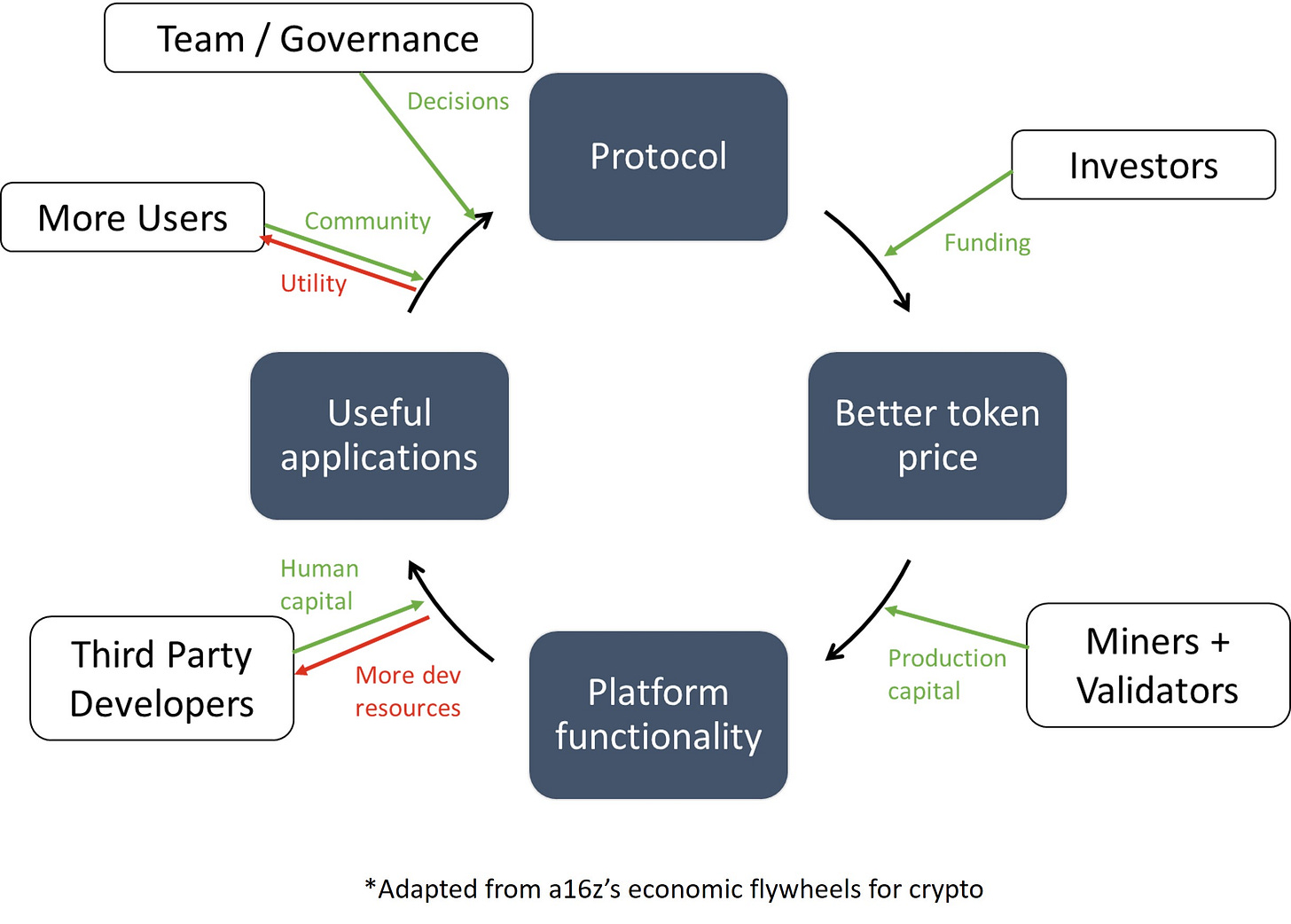

As a quick reminder on how we do these analyses; for any L1 technology I adapted a16z’s economic flywheels for crypto framework as shown below:

In principle, what happens here is the team designs, the protocol they input the decisions and stuff, the protocol attracts funding via investors and they give liquidity to the network, which gives a protocol its initial token price. Miners and validators are then attracted to supporting the network because of incentives (tokenomics) which improves the platform functionality because we're now validating blocks.

We now have a working blockchain with nothing being built on it so we turn to developers and try to incentivize them (via resources, grants etc) to build on the blockchain. They put human capital into building DApps and other useful stuff that people want to use attracting users onto the blockchain. These users form the community and eventually help govern the system.

Harmony ($ONE): Striking the right cord or striking out?

a) The promise: A solution that escapes the blockchain trilemma…

b) The reality: From a technical side the team are delivering, however they are a bit behind when it comes to attracting usage and in the level of funding compared to other L1s.

c) The rub: For Harmony to outgrow the shadow of other chains it's bets on DAOs being the future will need to show fruit through strong growth across a range of measures e.g. TVL, Active Users, Daily Volume and Community.

So the question is: can Harmony do it? Let's find out...

Today we’ll jump into each of the key areas of Harmony covering:

The origins of the protocol

The problem it is trying to tackle and what solutions it is bringing to market

Who are the investors and how do the Tokenomics work

How resistant the network is to attack?

What the developer experience is like

User growth and utility

Team and Future Governance

We’ll then round off with a bull and a bear case for Harmony ($ONE) and ecosystem.

Part 1: The Protocol

1a) Background and Vision

The inception of Harmony came from a simple question that the Founder Stephen Tse (@stse) asked: What is the biggest market opportunity now? Which product can capture the most value in the market right away?

His answer was platform infrastructure to power the decentralised economy.

The reasoning was as follows:

Internet technologies impacted millions of people and mobile technologies impacted hundreds of millions of people; now, we have a technology that can have a direct impact on 10 billion people in the future.

Makes sense to me…

Now Harmony is a fully fledge organisation with the stated vision for 2026 as follows:

Harmony is scaling Web3 infrastructure of DeFi and NFT. Our strategy is bringing the best results of Zero-Knowledge Proofs to production and decentralizing governance through thousands of DAOs.

This year the focus is:

In 2022 Harmony strives to be a top blockchain for cross-chain assets, collectibles, identity, and governance. Our main themes are:

Adoption — We are bringing utility to users through developers and partners. Hackathons with Gitcoin and workshops at Ethereum events will boost our reach.

Interoperability — We are bridging with Bitcoin and Ethereum for broader assets. Our cross-shard and cross-chain transactions will enable new finance applications.

Decentralization — We are growing our validator community and network features. External voting power and resharding will guarantee our long-term governance.

Zero-Knowledge Proofs – We are researching and prototyping products with 100x benefits, magical use cases, or universal constructs.

~ Harmony’s Strategy and Roadmap 2022 blog

1b) Problem/Solution

Harmony runs a Practical Byzantine Fault Tolerance (PBFT) consensus algorithm and combines this with a novel Effective Proof-of-Stake (EPoS) mechanism to provide fast time to finality (<2s), low costs and scalability.

Harmony is often compared to Ethereum with it’s upgrades implemented. This is because it has sharding enabled:

Random state sharding allows the network to divide the database into smaller segments called shards to reduce latency. In addition, sharding allows for near-instantaneous transactions while avoiding network congestion.

A key point to understand about about the choice of consensus mechanism is:

Harmony’s EPoS is based on the amount staked for each epoch (~ 1 day), but block rewards are based on the median staked by all validators. This discourages an over-concentration of tokens with any one node or group of nodes, increasing decentralization and preventing single-shard attack.

As of the beginning of 2021 Harmony is compatible with Ethereum, Binance Smart Chain, and Polkadot. Implementations for Uniswap V2, Chainlink oracle, and Bitcoin.

Part 1: Protocol Summary

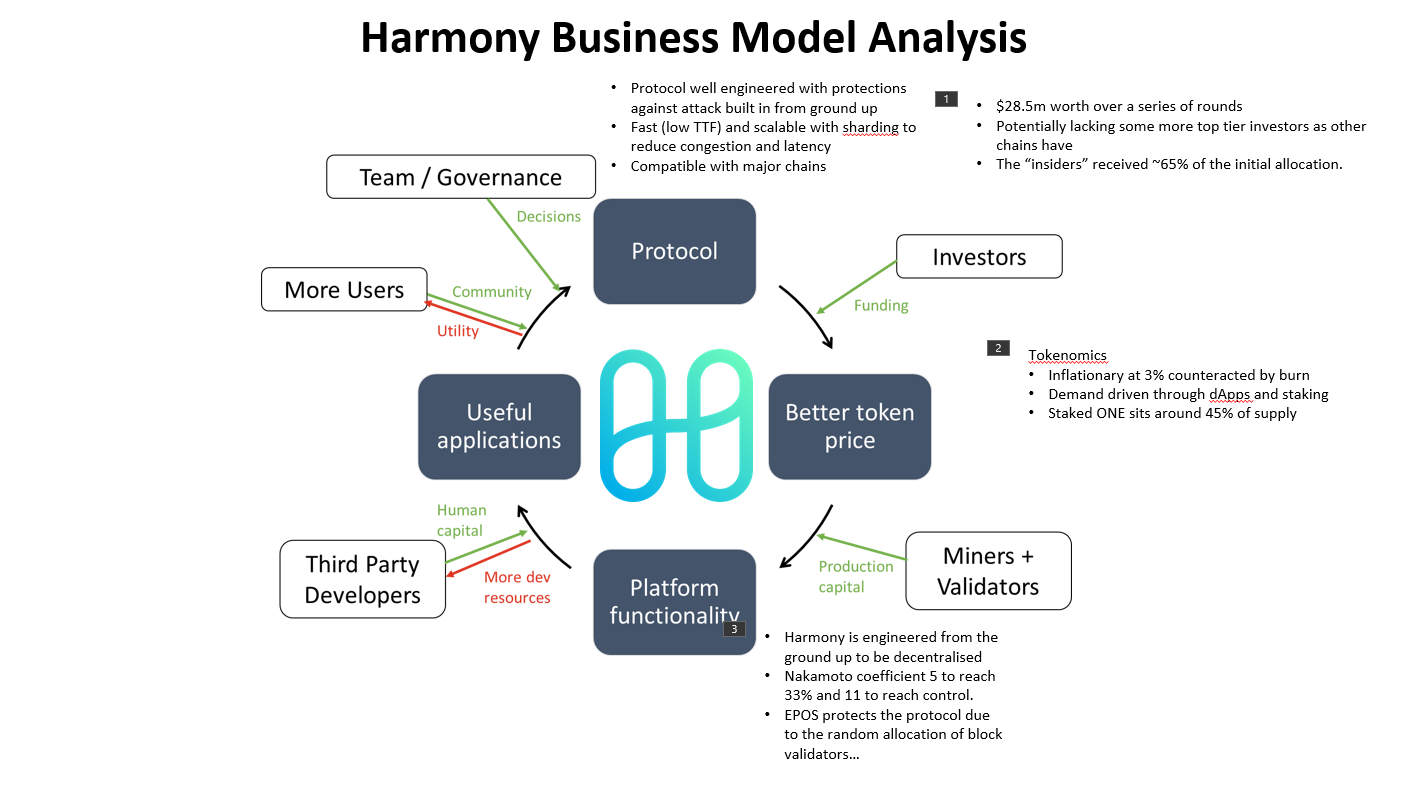

In summary then Harmony’s protocol is well engineered with protections against attack built in from ground up. It is fast (low TTF) and scalable with sharding to reduce congestion and latency.

Adding this to our L1 analysis framework:

Part 2: Investors, Tokenomics and Validators

2a) Investment Rounds

According to Messari, Harmony had three funding rounds; seed, node and IEO:

Based on the above prices the ROI for investors at each stage is:

2b) Who backed Harmony?

There are a number of investors who participated in the seed round for Harmony:

Similar to Fantom we could say that a fault of Harmony is that they don’t have what is considered the top tier investors in their round (a16z, Sequoia et al).

2c) Investor Token Allocation

Harmony is very open with the initial supply distribution, the token allocation is as follows:

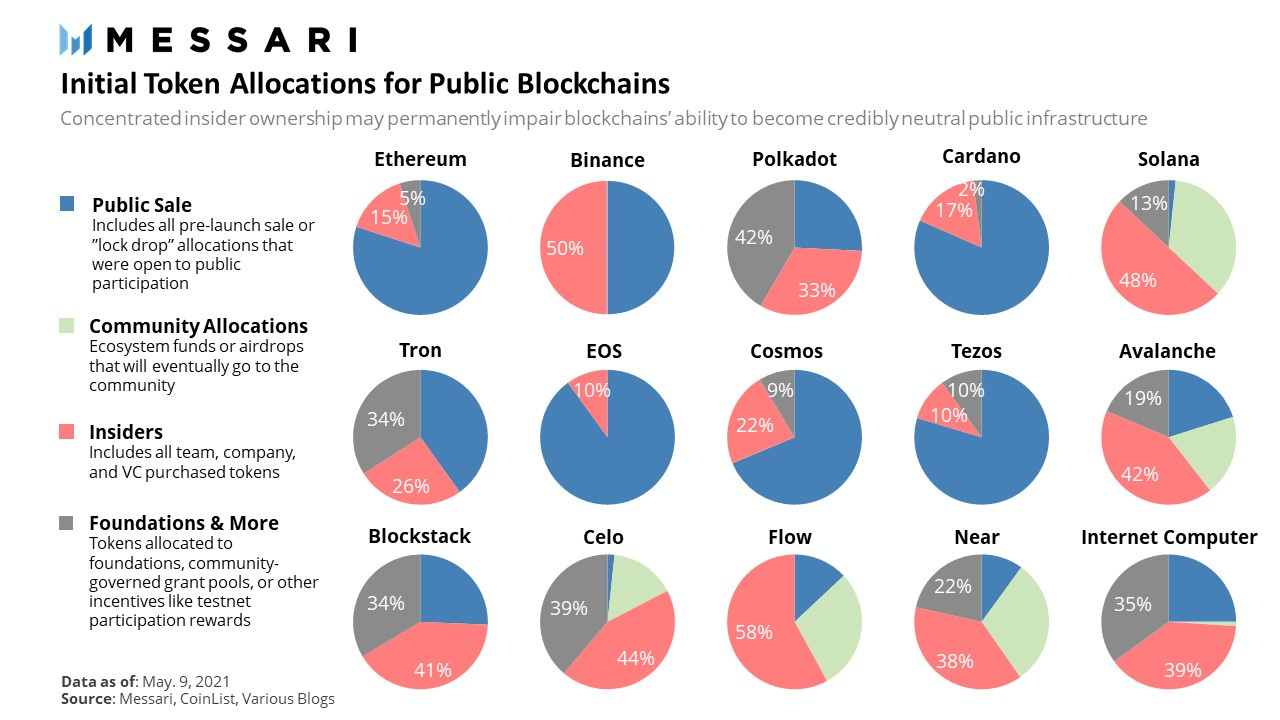

We can see that insiders hold 65.7% of the tokens when the chain was launched (I’ve assumed IEO sale and ecosystem are non-insider allocations).

Using the below data from Messari this seems in line with a lot of the newer chains (Near, Avalanche, Celo) that required VC funding.

2d) Tokenomics (Supply)

As we’ve already seen Harmony is targeting an annual inflation of 3%. They detail their tokenomics in this medium post. This makes changes to an older model where there was a variable issuance schedule, which you can read more on here.

On the supply side, Messari provide the details of the liquid supply curve:

The following commentary was added on the supply curve:

For ongoing staking rewards, Harmony's economics model caps the annual issuance at 441 million tokens (about a 3% rate in long term). This model aims to give validators a predictable return. Harmony also burns all transaction fees in an effort to lessen the inflationary impact of a fixed annual issuance. The Liquid Supply Curve does not reflect future tokens burned as this number is less predictable.

~ Messari

Looking at the composition of the supply as of today vs in 4 years time we can see that we still have a large amount of staking rewards to be released (~2.2m $ONE), as well as around 1m $ONE for the ecosystem development and a smaller amount for the team.

This is useful to know as the supply side pressure will be mostly from staking.

What else could effect the supply? Well back in 2020 Harmony performed a burn of some 319M $ONE. We could see this happen again potentially, although afaik it was a one off to offset some early mining.

2e) Tokenomics (Demand)

On the demand side we have Transaction fees. The Harmony team point to issues with Bitcoin’s economic model where it is unclear how participants will get paid after a certain point.

Therefore they have modelled their issuance rate to settle at 3% a year after considering how many tokens will be burned with increased usage.

The other uses for ONE are (as per Messari):

For running a node (minimum 10,000) or staking (minimum 100) in Harmony’s Effective Proof-of-Stake (PoS) consensus to earn block rewards and transaction fees. Stakers who double sign have their ONE slashed.

To pay for transaction fees, gas, and storage fees.

For on-chain governance (currently only for validators).

2f) Validators and Miners

To participate in Harmony as a validator you will need 10,000 ONE tokens, for delegators that drops to 1,000 ONE.

This is relatively low compared to some other chains and as such Harmony has a good amount of validators for a relatively small chain:

To keep validators honest Harmony employs slashing, but doesn’t penalise stakers for downtime like other PoS blockchains.

All of this has led to a participation rate of 45.22% according to Staking Rewards and a total of 107,359 wallets staking.

2g) Centralisation

Harmony is engineered from the ground up to be decentralised. Using the Nakamoto coefficient we can assess decentralisation.

Assuming that 33.34% and 51% control is required to stop and then to corrupt the blockchain then according to the list below we would only need 5 to reach 33% and 11 to reach control.

This sounds bad however due to the choice of consensus mechanism, the protocol is protected due to the random allocation of block validators…

Part 2 Investors, Tokenomics and Validators Summary

In summary then Harmony has raise $28.5m worth over a series of rounds but are potentially lacking some more top tier investors as other chains have. The “insiders” received ~65% of the initial allocation.

The tokenomics are inflationary at 3% balanced between issuance and burn, with demand driven through dApps and staking, of which staked ONE sits around 45% of supply.

Harmony could have had issues with centralisation as Nakamoto coefficient is low at 5 to reach 33% and 11 to reach control but EPOS protects the protocol due to the random allocation of block validators…

Part 3: Developers

3a) Developer Support

There is a lot of support from Harmony for developers working in the ecosystem. A recent example of which is their launch of Zero-Knowledge university with the aim upskilling 1,000 developers by 2024:

3b) Developer Growth

Electric Capital Developer Report (2021) shows Harmony is growing fast in the number of developers, with 4x as many as in 2020. Only Fantom, Terra and ICP are also in this bracket.

In addition it is one of the fastest growing developer ecosystems:

3c) Grant program

Harmony have a $300m incentive program which may be on the smaller end of the funds announced by other chains as the block’s research report shows:

The money is going to be spent in the following areas:

There has been progress with a number of proposals getting funded so far:

If you would like to dive into any of the projects you can have a look through this thread:

My one concern here is that (in my experience with DAOs) is that they can be hard to structure and get going.

Do I think DAOs are the future. Yes. Do I think they are easy. No.

An alternative approach would be to accelerate top hackathon teams by partnering with an incubator in the space.

This will go down the path a16z laid out in their piece of progressively decentralising, and enables teams to experiment quickly to find product market fit then exit to the community.

Monitoring this area will prove whether I am wrong or right on this.

Part 3 Developer Experience Summary

Harmony has tooled up the ecosystem and captured the interest of many developers. It has a $300m incentive program which may be on the smaller end. Other L1s e.g. Avalanche, Near and Hedera have bigger war chests to lure dApp builders to their chains.

The money is going to be spent primarily on DAOs which imo may be an issue as DAOs have proven to be tricky to manage (imo).

Part 4: Usage

4a) Onchain analysis

4a.i) Unique Addresses

Harmony recently hit 1.1m wallets:

4a.ii) Daily transactions

And an ATH of 5.4m transactions!

Comparing these numbers to other chains we can see that Harmony is on par with some of the largest chains like BNB, Polygon and Luna:

4a.iii) TVL

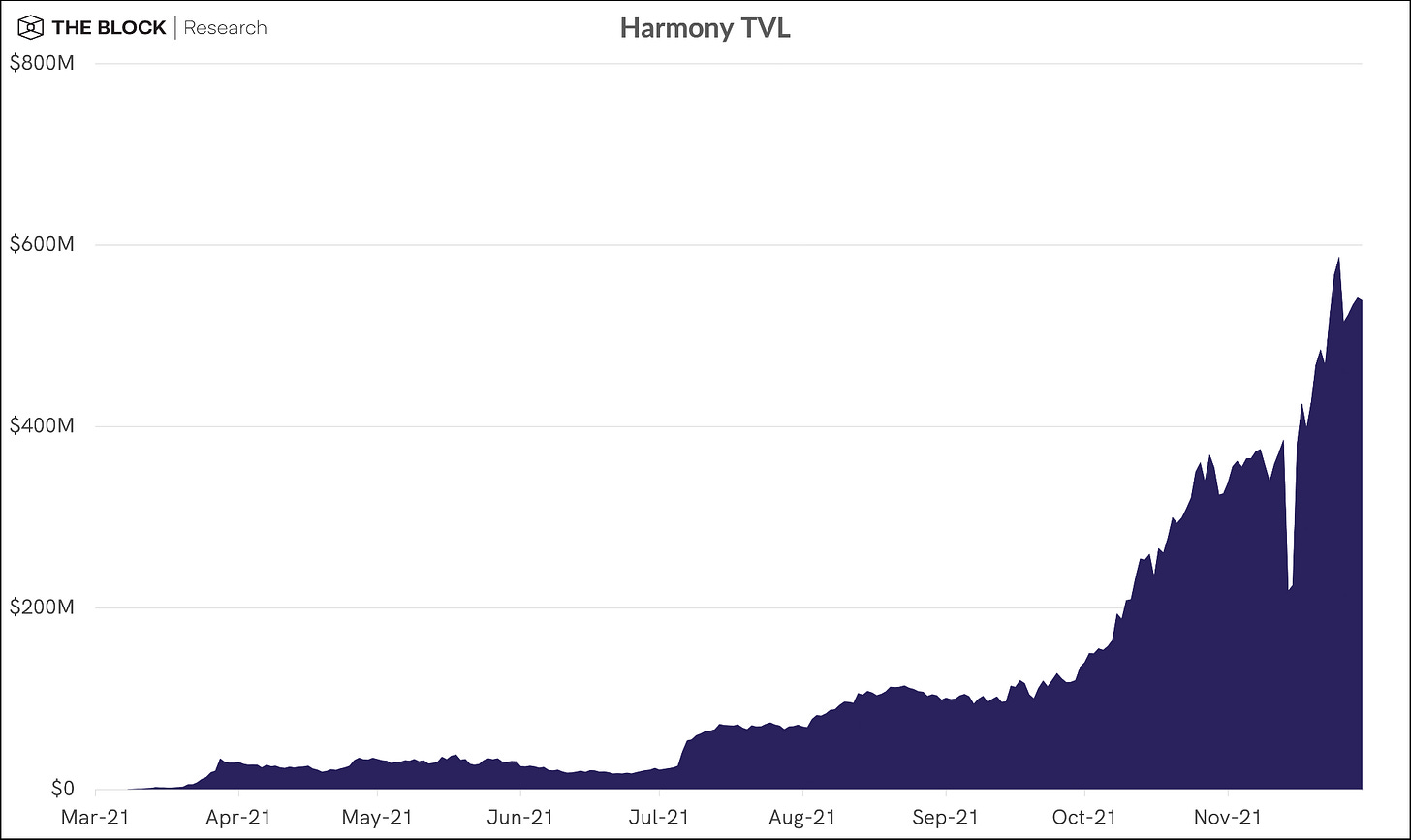

Harmony attracted a large amount of TVL in 2021 as shown by The Block’s 2022 Report:

Compared to other chains the have done relatively well in this regard as they are one of the leaders when we normalise for price.

Bridging from Ethereum

One aspect of TVL will be bridged assets from Ethereum, with Messari showing the growth over time in Harmony’s Bridge to Ethereum:

However Harmony still represents a small amount of the bridged assets in the market with $476,677,683 in TVL, compared to other chains this represents 2.2%.

4b) Off Chain Metrics - Socials

Harmony has a smaller community than some of the other chains we have looked at but still growing:

Looking at this compared to other L1s shows the level of attention $ONE is getting:

4c) dApp Ecosystem

Ecosystem maps are a great starting point to begin to understand what’s going on. We can compare the end of 2020 map:

Here is the updated map for the end of 2021:

Even qualitatively we can see the growth.

Harmony put out a blog on the progress in 2021 that you can find here:

In terms of the number of dApps and how this compares to other ecosystems Harmony has 82 (according to harmonyuniverse.one). This is larger than the numbers for Solana (51) and Cardano (70) but less than similar chains Avalanche (201), Luna (160) and Fantom (144).

4d) dApp Highlight: DeFi Kingdoms $JEWEL

DeFi Kingdoms is a cross-chain, play-to-earn MMORPG built on a strong DeFi protocol. The game features DEXs, liquidity pool opportunities, and a market of rare, utility-driven NFTs, which all together create a beautiful, immersive online world in the incredibly nostalgic form of fantasy pixel art.

After initially launching and attracting huge amounts of interest and users DeFi Kingdoms is now at a much slower rate of growth (although +20% in a 30D time period is still big).

The recent spike in activity is largely down to launching a bridge to an Avalanche subnet (more below).

TVL tells a similar story having run up impressively in the initial period it has since stalled a bit hovering around the 3b ONE mark in TVL

Interestingly however their DFK chain hosted on an Avalanche subnet continues to add demand.

The team used Synapse protocol to launch at it instantly took off showing the huge amount of demand that sits behind this game.

This interest is sure to capture the attention of other chains… which seems to be playing out nicely:

Here’ to seeing a Terra ($LUNA) integration soon 💯

Part 4 dApps and Usage Summary

In summary Harmony ranks reasonably well to its peers across a number of factors:

The major areas that will need some work are

Daily transaction volume - which will be improved by more great dApps,

TVL - although it did well relatively to the rest it is still behind and may require much larger incentive pools of cash to capture more interest

Community activity - needs some amplification which will come with time but may be a good use of some of the investment funds

Part 5: Team

I’ve lifted this straight from Chain debrief so as not to repeat the same thing:

The team behind the Harmony network is impressive, with a combination of experts coming from the likes of Google, Amazon, Apple, and Microsoft. They have also worked on some of largest technological systems in the world such as AWS infrastructure and Google Maps.

The CEO of Harmony is Stephen Tse, who has spent his life working on security protocols. He transitioned from a career as a Microsoft Researcher, to a senior infrastructure engineer at Google, and to a principal engineer at Apple. He later founded a startup called Spotsetter which was acquired by Apple.

The additional co-founders also have impressive backgrounds as veterans of artificial intelligence. The Harmony team is also transparent with the community, something many appreciate. Status update meetings over Zoom are available to the public for viewing via YouTube. This has made the community more understanding and supportive of Harmony, despite delays in some areas of this impressive project.

One thing I really like about the team is that they are very public about their progress and hold regular community calls to allow people to understand why parts are behind or ahead of the expectation. In this way I think they are quantifiably being held accountable by the community, which imo will serve them well in the future.

5a) Governance

Governance on Harmony is done through an app and is available to all Harmony holders, although you must be an elected validator to propose an amendment.

A proposal has to be submitted by an elected validator. The proposal shall include a summary in the content and a link to a post in the “Governance” section of the forum https://talk.harmony.one so that the community can discuss and debate in the forum post.

A proposal will be moved forward when the majority is reached. Otherwise, it is rejected. The majority of the quorum is defined as more than 66% of all the staked tokens.

Since only the validators can propose/vote in the proposal, for token holders who delegate to validators, it is highly encouraged to work with your validators to vote on the proposals. Also, in order to encourage the participation of the voting process, additional token rewards may be distributed to validators who voted in the proposals. The detailed plan will be announced later.

Harmony has seen a 113% increase in the number of proposals being suggested in the Forums, which is a good sign of the engagement in the community.

Part 6: Closing Thoughts

This brings us to the end of our analysis part now we put it all together for the Bear and the Bull Cases for Harmony.

🐂 Bull Case

The protocol has been engineered cleverly and AFAIK hasn’t had any major issues since launch.

Harmony can continue their current trajectory, outperforming bigger chains on a relative basis they will catch up.

DAOs do become the future and Harmony will have bet the farm

The announcement that Do acquired Avax via the LFG raises interesting prospects for other chains. With the interest already in DeFi Kingdoms, the optimist part of me says a similar announcement could be on the cards for $ONE.

🐻 Bear case / headwinds

Competition for TVL: Already this year we have seen Fantom rack up a lot of TVL and then promptly have a sell off as Andre left. Something which isn’t reflected in the blocks research. I will be looking at this area closely as it develops over the year.

Competition for developers: Raise a bigger ecosystem fund (~$1b) in conjunction with a leading equity provider, the team has close ties with Binance so this could be a strategic partnership. And there’s a precendent for it

As mentioned above DAOs are hard at the moment: DAOs can be hard to structure and get going (from my experience), an alternative approach would be to accelerate top hackathon teams by partnering with an incubator in the space. This will go down the path @a16z laid out in their piece of progressively decentralising, and enables teams to experiment quickly to find product market fit then exit to the community.

Conclusions

Overall, Harmony has promising tech, robust onboarding processes for new developers, interesting initiatives to drive usage and a great team who quantifiably keep themselves in check and regularly have touch points with the community. This has been one of the easiest projects to research thanks to their transparency (which I think is broadly appreciated).

Team & community & projects accounts you may want to follow:

@stse, @harmonyprotocol, @amythesoon, @ONECreativeDao, @lijiang2087, @givp, @samuelpharrison, @shmula, @OniiiONE, @kratos_harmony, @OneCommunityDAO, @ShroommaNL, @MonstersRocket, @Bricktop_ONE, @TimPos4,

..cont. @DefiKingdomsITA, @cptomonk, @TaikiMaeda2, @logicalgraphs @Gojo_Crypto, @yellowpantherx, @digitalslowmad , @DreamerDFK, @DefiKingdoms, @planetleague, @CoalMiner_Game, @EthereumRio, @ThreeFoldComics, @GetMyProof, @GetMyProof, @VibeStreamNet, @curio_invest, @harmony_podcast

..cont. @DeFiatoOfficial, @kalamint_io, @DuelistKingNFT, @TavernDAO, @AmbassadorDao, @RachelBHarmony, @harmony_dev_dao

FIN

As always DYOR this is not investment advice, also I might have missed stuff that is a key technology thing that you may understand better than I do.

Hope you enjoyed this deep dive into Harmony, I will be talking about it a lot more on Twitter. So if you follow me there @0xGregH that will give you the latest.

If you liked this content, please give us a share and tag me!