Investment Memo: Near Protocol ($NEAR)

Long Term Potential: Is the Ethereum Killer worth buying?

Welcome to the inaugural edition of Altcoin Evolution! Thank you to my existing 319 YouTube subscribers and 270 Twitter followers.

📺 Don’t like to read? Get the video version of this essay on YouTube

Hello world,

Happy Tuesday and I hope it’ll be a good one as its the last working Tuesday (for me at least) of this year!

As this is my first essay on Substack, hi my name is Greg and I am Web3 builder @Peerkatofficial; analyst via Altcoin Evolution (firstly YouTube but now this newsletter!); and most recently DAO contributor @ScribeDAO. I’ll keep a proper deep dive intro to me for another post.

Now onto Near Protocol. I found out about Near when we (Peerkat formerly Vivid IoV Labs) worked with the technology as part of the Future of Blockchain Near Protocol hackathon. After that initial meeting, we touched base with the team a number of times even getting through to the final selection for Open Web Collective, a Near affiliated accelerator, but our vision and DApp never quite aligned to what they were seeking. So while I haven’t actively been working with the protocol I do have a decent insight into it, the people behind it and the projects being built on it.

And without further ado then let’s do this…

Near Protocol: Ethereum “Killer” worthy of a bag?

As always this is not investment advice… DYOR

Background

What do you get when you cross:

A brilliant ML/AI researcher

A lead database engineer who builds highly performant SQL DBs

You’re right, an AI company…

NEAR was a machine learning project before it became a blockchain development platform.

Illia Polosukhin (@ilblackdragon) and Alexander Skidanov (@AlexSkidanov) started NEAR.ai in early 2017 to explore program synthesis: the field of automating programs from a human specification. Named for the science fiction novel The Singularity Is Near, the NEAR project drew from Illia’s work as a lead contributor for TensorFlow at Google and Alexander’s as the lead engineer at MemSQL.

However, they then pivoted. And got funding to build a scalable blockchain platform.

Their new mission is succinctly put in Illia’s Twitter profile:

L1 Analysis Framework

Before we jump in a little explainer.

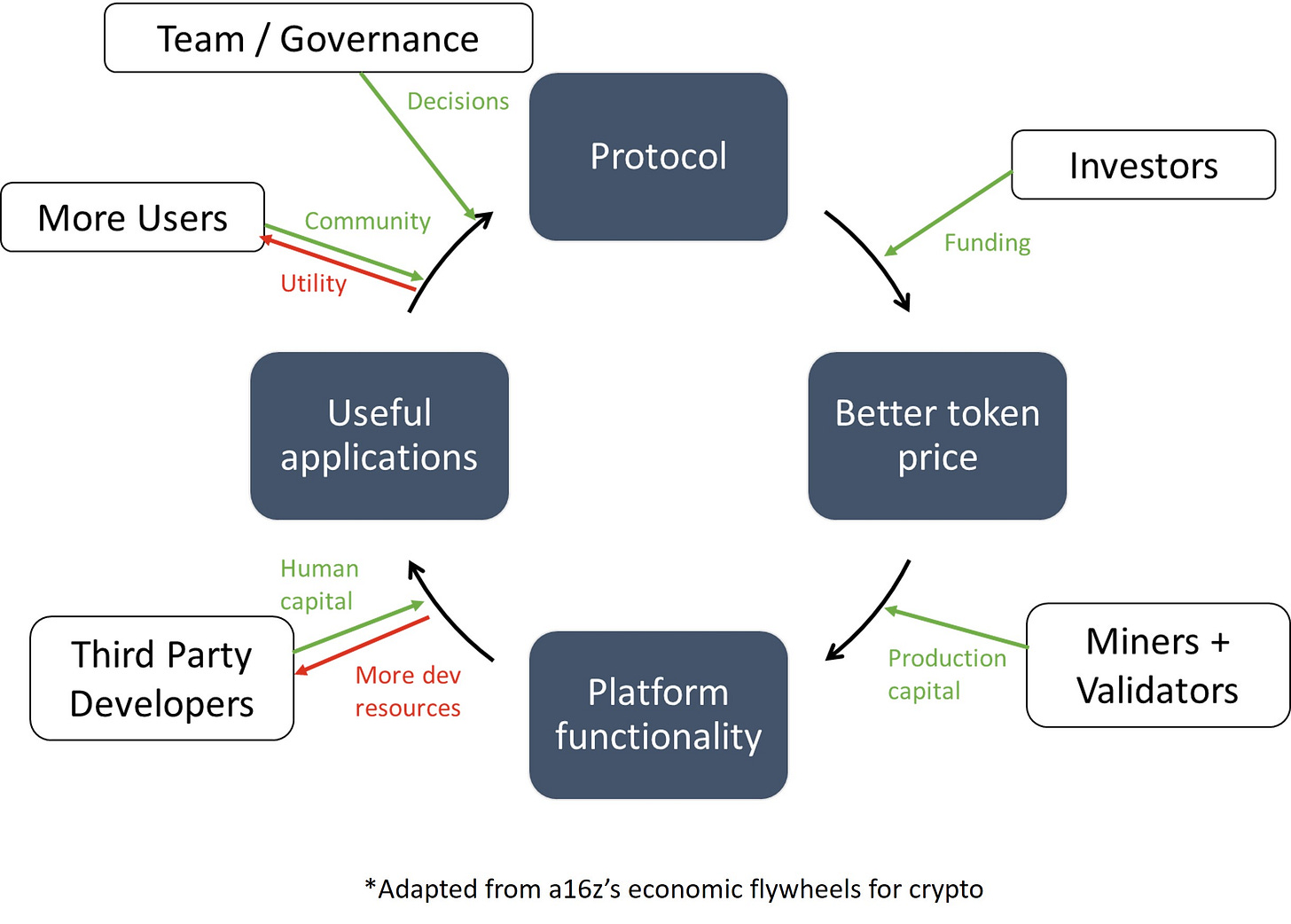

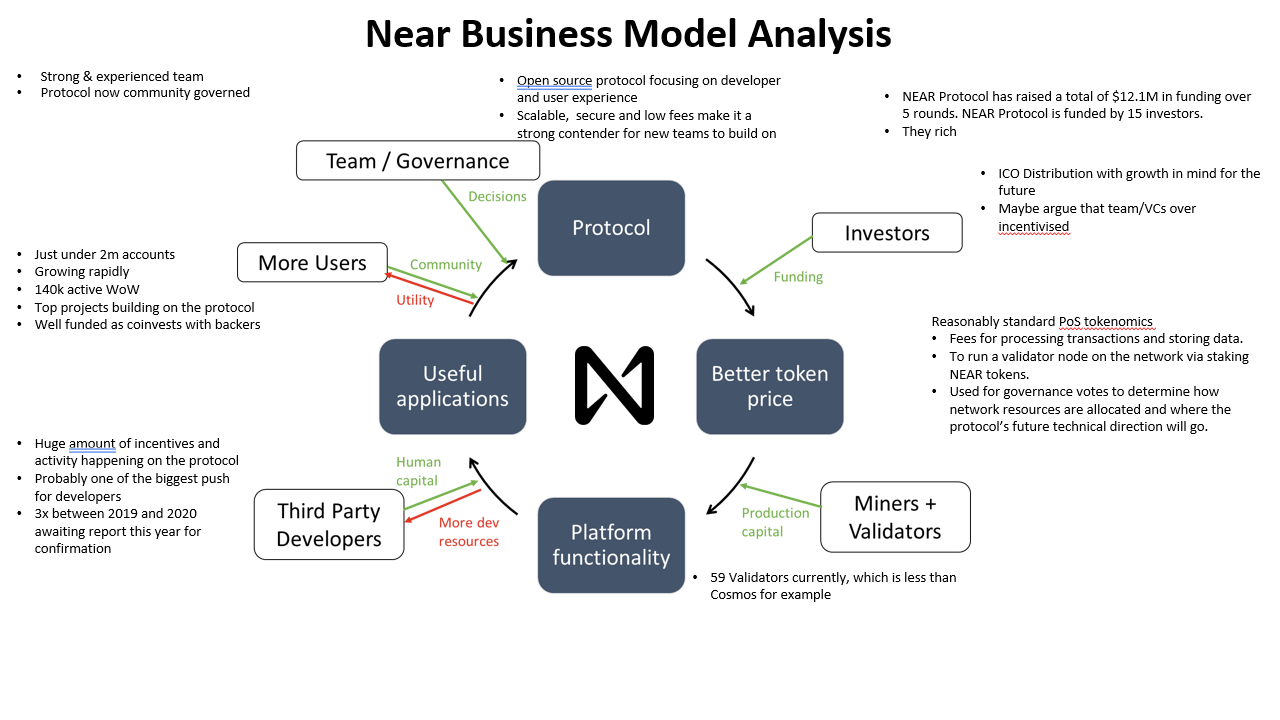

For any L1 technology I adapted a16z’s economic flywheels for crypto framework as shown below:

In principle, the team designs the protocol which attracts funding via investors, who give liquidity to the network. This gives a protocol its initial token price attracting miners and validators to support the network because of the incentives (tokenomics).

Because we're now validating blocks, we now have a working blockchain!… With nothing being built on it! So we turn to developers and try to incentivize them (via resources, grants etc) to build on the blockchain. These teams put human capital into building DApps and other useful stuff that people want to use attracting users onto the blockchain. These users form the community and eventually help govern the system.

This is a flywheel as the more of each area we add the faster the flywheel spins creating momentum in the ecosystem building competitive moats.

Here is where Near is up to…

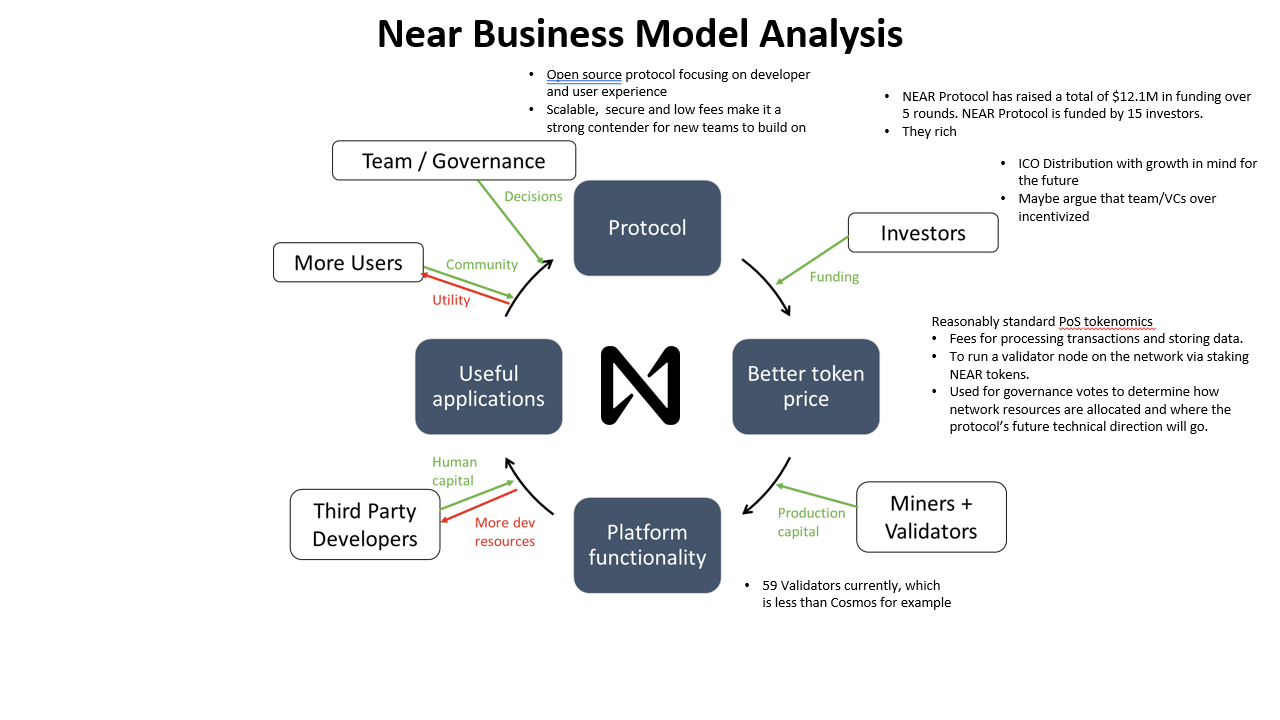

What is Near Protocol?

Near is an open-source programmable blockchain that is proof of stake. It allows developers and anyone else to build and deploy decentralized applications.

The problems Near hopes to solve, as is the way with most Ethereum killers, are sustainability, cost, effectiveness, security, scalability - basically the stuff Ethereum hs tried to correct since launch but hasn’t quite got right… yet.

Near has a strong focus on developer experience and has heavily invested in tooling and making the onboarding for new dev teams as simple and as painless as possible. Something which I think makes it stand apart from Solana or Avalanche.

So for our first one at the top there, the protocol, is it fit for purpose? Their mission is to enable developers and users. And as far as I can see is a good fit is scalable. It's secure as low fees, which makes it a really strong contender for new teams to build on.

Investors

Next up investors. When Near was launched, there was a genesis distribution, and they laid this all out really nicely in the blog post. There were a billion tokens created at launch, but a fair chunk of that went to the team.

If you hold decentralization as a core value you might not like this chain as much as say, Ethereum which is much more free of VC’s incentives (arguable).

This was one of the VC backed chains. Near have raised 12.1 million in funding according to Crunchbase with the latest funding round was a 2021.

It's backed by some of the biggest names in the industry, a16z, electric capital, Ripple’s corporate venture arm Xpring, as it was called now, ripple X, you've got Dragonfly Capital, Hybrid Ventures, basically the who's who in crypto funding has a back Near and they all have really deep pockets.

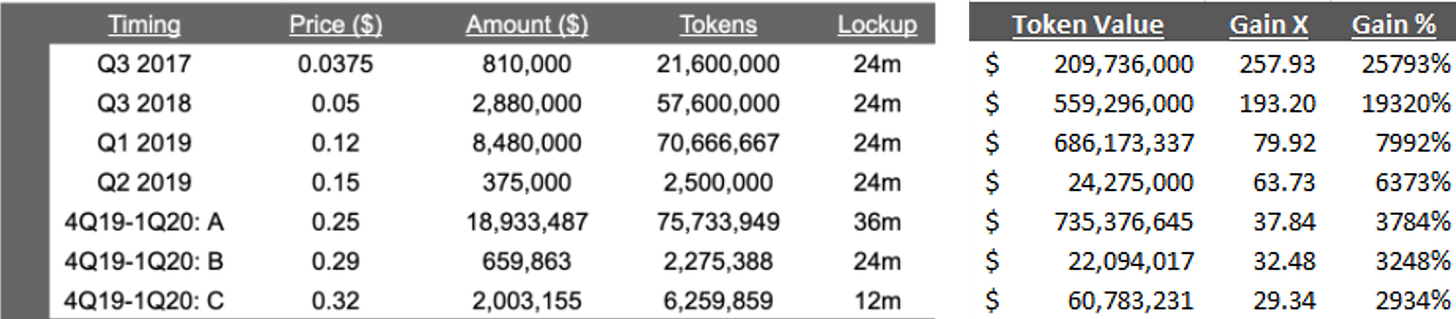

In the previously mentioned blog post, Near outlined their are early investors and the amounts and what they put in.

So I went through and worked out on the right-hand side, how much those tokens would be worth today.

Near has raised from backers in several tranches, which are explained above. The first people to put in made a 257x gain on their investment which is just huge and all the way coming down to the latest one who 29x their monies.

These guys are very well off now if they weren't already. We do seem to be missing a couple of the later rounds because they also raised one in 2021 according to crunch base. But it just goes to show how being early is so important in this.

In terms of circulating supply now we saw that after the initial distribution Near is slightly inflationary - to help scale with demand, as more tokens are released as time goes on.

While the vast majority of the initial supply was locked up in line with the previous table it is worth understanding how the total circulating supply changes over time.

In summary then; the early investors did well. Near did the ICO distribution with future growth in mind, which I think is really good. You could maybe argue that the team / VCs are over incentivized.

Tokenomics + Validators

So let's talk about staking incentives and rewards. As we know, Near is a proof of stake system. It has a pretty standard set up here. There's fees for processing transactions. There fees to run a validator node and you can stake Near tokens. These are also used for governance votes to determine how the protocol develops.

In terms of the validators, there's about 59 on the network, about 410 million near is staked.

It's not overly centralized. The top pool has 10% stake which is quite high but you've only got 59 validators at the moment. In comparison, Cosmos, we saw that there was 150 as shown below..

Which meant that the cumulative state was a lot lower for each validator. Hopefully this will decentralize more over time.

In terms of tokenomics, there is a slight deflationary pressure on Near as fees are burnt but they are incredibly low. This link shows that more than a billion transactions per day is required to even make a dent.

In summary then, Near is proof of stake, tokenomics and the validators, as I said, you know, less than someone like Cosmos, for example however, it's still quite decentralized. And hopefully that becomes more so over time…

Third Party Developers

Developer interest where is where I think it really gets interesting. I did talk about this in my old video and back in March, as electric capital release a report last December that stated Near had 3x’ed their developers from 2019 Q3 to 2020 Q3. So it was one of the fastest growing protocols.

This number is likely to have grown significantly as Near has put aside a large grant proportion of their tokens (17%) as set out in the distribution schedule. If we take 17% of current circulating and supply, I calculated that it's about a billion dollars that they have there to distribute as grant funding.

581,416,458 × 0.17 = 98,840,797 NEAR for grants ~ $1bn

Having that vision from the from the sort of initial Genesis to keep stuff aside for grants seems to have been a master stroke.

My numbers do seem to be about right as Near recently announced an $800 million dollar ecosystem fund which is just massive. It's the biggest one I’ve seen.

To put that into context, I know that XRP recently got a $250 million fund. We did look at cosmos the other day, which also has a grant program:

These chains have huge amounts of money to back promising projects.

For Near the 800 million is split into two funds, so there's $350 million for DeFi specifically and that's run by proximity - I touched on them in my other video, so check that out.

The other part went in part to Human Guild, a sort of accelerator program in a way that has funded some really great projects.

They seem to be doing quite well at picking winners; Paras, for instance, hit $532 million in daily volume. So really seeing some great usage there.

So yeah, huge amount of incentives and activity happening on pro protocol. Probably one of the biggest push for developers and they seem to be choosing the right stuff as well, which we'll come onto now in terms of users.

Utility and Growth

Looking at usage, the market cap is $29.7 billion for all the protocol ecosystem. They had $2.7 billion trading volume in his last 24 hours, 11,353 coins on there, which is just huge.

In terms of sort of overall charts the amount of gas usage is a good proxy for onchain activity and as you can see it's trending upwards.

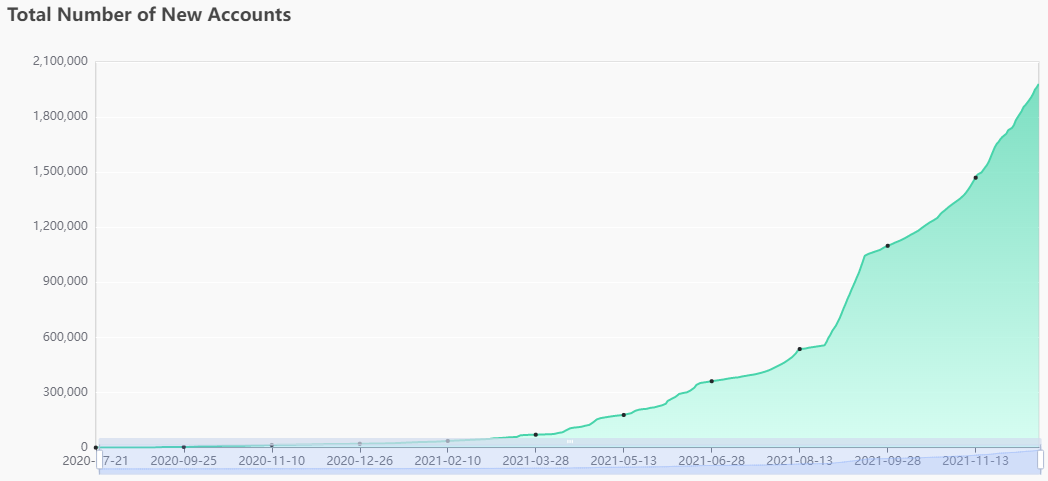

In terms of total number of new accounts, you can just see this explosive growth. We're at the end of 2021 now, and you can just see how it's absolutely taken off in the past year, which isn't really a surprise given we've been in a bull run.

Really strong in terms of the projects I dived into these in great detail in my other video.

Back to our framework we have: 2 million accounts growing rapidly, you had 140k active wallets week over week which shows the activity on, on chain is just. We have some projects being built on the protocol and it's, well-funded kind of following on from the last from the third party developer stuff. There's lots of grant money available there.

Team and Future Governance

As mentioned at the start the team that originally founded Near Protocol actually started out as a machine learning project before it became a blockchain development platform.

The governance now is split between the Near foundation which acts as a steward of the grants and a decentralized system.

Near Foundation

One area I neglected to mention in the video version of this essay was the Near Foundation, which will guide the deployment of the various grants and help develop the ecosystem.

Governance

In terms of how Near is governed. It is in fact already decentralized but announced recently that is working with Commonwealth to build a fully end to end governance platform that will support:

Sputnik DAO Support: The NEAR forum on Commonwealth supports all DAOs within the NEAR ecosystem using Sputnik v2. Users will be able to launch DAOs with their own full governance forum and have a place to grow that DAO community.

On-chain Governance: The NEAR Protocol will be able to discuss, vote, and execute on governance proposals all on-chain through the new Commonwealth forum.

Wallet Login: NEAR community members will be able to login to the governance forum using their NEAR wallets.

While it has been decentralized for awhile this is the next big step. And that really speaks to the future being in the hands of the people.

Framework complete!

Grading

Let's go to grading. So in terms of near as long-term potential, then for me, the protocol great use case fit the incentives are well aligned and the dev interest is strong with funds, ready to deploy, to support the growth that they're seeing.

The team has experienced and it's community run so people can have input in it. And I think the hype is just perfectly justified.

Straight up nine out of 10, one of the strongest products projects I've seen with great backers, a good setup to further develop the ecosystem. And I would say this is a strong long-term hold in my estimation, of course always do your own research with these things.

I might have missed stuff that is a key technology thing that you may understand better than I do. But for me near protocol is one for the long haul.

Hope you enjoyed this deep dive into Near Protocol, I will be talking about it a lot more on Twitter. So if you follow me there @0xGregH that will give you the latest.

If you liked this content, please give us a share and tag me!