Issue #10: What most founders get wrong about funding...

Reading time: 4.5 MinsGetting funded is hard.

For start-ups in the tech space it is the typical path to fund product development to the point where it can start generating revenue, and (eventually/sometimes never), for the company to break even.

However, for first time founders the process is confusing and can seem like a thankless task.

How the process goes wrong…

There are many reasons why founders get the funding process wrong:

They don’t know who they are looking for, approach VCs who won’t invest and wasting precious time.

When a VC seems interested it sets off a scramble to pull stuff together, resulting in poor work and conveying that a team might not be the ones to back.

They don’t have a good process to track and monitor conversations.

The good news is that it doesn’t have to be this way and, as founders, we can take steps to understand the process and what is required.

Step 1: Realising this is a search, not a sale.

Getting funded is a search with the goal of finding a person who has money (either as an angel or part of a VC) that already believes that you are in the right market.

Conviction in the market is by far and away the most important step to investment.

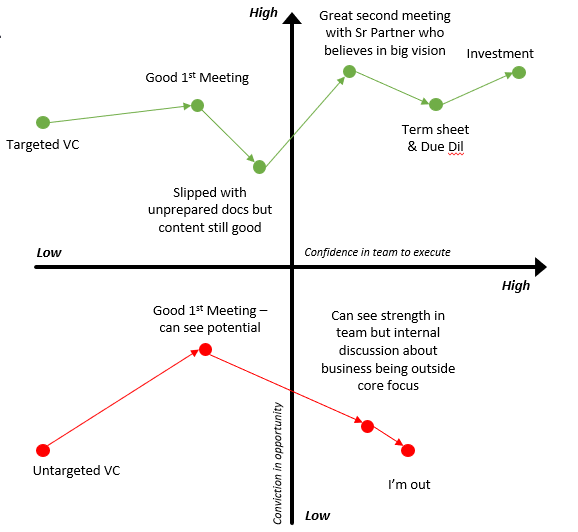

Yes people have invested in the strength of the team or in people who they already know (as the blue line shows).

The friends money is useful in the beginning to get things off the ground but as some point you will most likely need to convince someone who doesn’t know you and the team that you can deliver.

Conviction in opportunity can be tested for in a number of ways before reaching out to a VC. Simple questions like these can help:

Are they investing at my stage? Don’t approach a Series B+ fund if you are pre-seed.

What is the fund focus? Again don’t approach a climate tech fund with an idea for a social network.

Other than looking on fund websites, you can leverage Twitter (and TweetDeck) to find analysts at the major funds and follow their thinking.

Step 2: Each interaction either adds or subtracts confidence

The next job you have is to build confidence in the investor that you are the team to deliver.

When convincing someone who already believes in the market you need to treat each email, meeting or other touch point as something that will either add to your case or subtract from it.

Using the diagram you can see how even though both VCs are feeling confident in the team after each touch point it’s not a straight forward path.

At a high level confidence is built through a number of ways:

Market size/opportunity - are you in a market that can support a billion $ company?

String team - do you have the relevant experience or backgrounds to make this happen?

Traction/growth - if you have a live product, how is it performing? Is it growing at 7% a week?

During Y Combinator we measure growth rate per week, partly because there is so little time before Demo Day, and partly because startups early on need frequent feedback from their users to tweak what they're doing. A good growth rate during YC is 5-7% a week. If you can hit 10% a week you're doing exceptionally well. If you can only manage 1%, it's a sign you haven't yet figured out what you're doing. ~ Paul Graham founder of YC

To best prepare for meetings/other contact you should have all your documents in order - called a data room.

You can read more in the articles here on what to include:

Marsdd Part 1 - https://learn.marsdd.com/article/data-room-basics-for-startups-stage-1-data-for-the-term-sheet/

Marsdd Part 2 - https://learn.marsdd.com/article/data-room-basics-for-startups-stage-2-data-for-investor-due-diligence/

During meetings it is handy to have some questions for the VC. I liked this post on a few good ones: The Key Questions For Founders To Ask VCs During A Pitch

Step 3: Keeping track

While you move through the process it is critical that you make notes on every conversation and keep track of who you have reached out to.

My go to for this is Hubspot.com (not an affiliate). I use it to track any of my emails both outbound and inbound, as well as call notes and tasks to follow up.

Alternatively you can use a spreadsheet, for which here are a couple of templates:

Pillar VCs founder tools

Techstars - MD of NYC on using GSheets

The full process may take place over several months so notes, previous emails and other key information must be stored and ordered well.

The reason for this is that you will receive a lot of no’s until one VC says yes.

At which point you should then go through the list of previous contacts and see if they’re now interested.

Conclusion

Funding is hard, but lots of people manage to break through.

The keys to a good process are:

Remember it is a search - don’t get down when you hear no, they are just not the right person

Add confidence - be ready and have a plan backed by documents ideally

Keep track - take notes and reaching back out will be easier

That’s it for this weeks newsletter. Thanks for reading 0xGregH! Subscribe for free to receive new posts and support my work.