Let's take a look at the opposition to Web3

An mini investigation into anti-crypto thoughts

On April 1st (afaik this was not a joke) former SEC Chief of Internet Enforcement @JohnReedStark published the thread below on crypto.

In 5️⃣ parts we'll take a look his points and use examples/data to see what we make of them:

Part 1: Crypto lacks real use cases

1/ Bitcoin (I assume even though no one knows if Satoshi was just one person) has no use case:

2/ Bitcoin does in fact have a number of use cases the strongest argument for which imo is that it is one of the ultimate forms of pristine collateral.

Collateral is something that can be pledge to show a guarantee of payment.

3/ Pristine collateral has been applied to gold and other assets with a fixed supply, which is why Bitcoin can sit alongside them with supply cap of 21 million.

Read more from @RaoulGMI here:

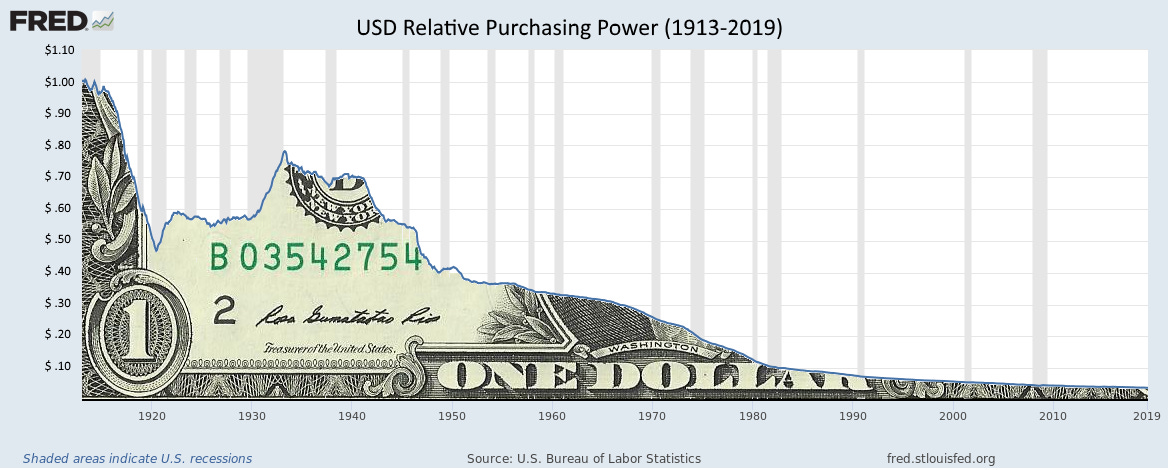

4/ Fiat currencies get their purchasing power slowly eroded (in general) over time because they inflate.

As an example $100 in 2010 = $85.95 in 2020 the same $100 worth of GBP would be $77.48 in 2020…

Or as another graph from Dane Klocke shows:

5/ While BTC appreciated massively in the same time span ($100 = $9m in 2020), the volatility of the asset will likely come down over time. But the supply cap will remain.

This makes a “leave it under the mattress” strategy to Bitcoin appealing.

6/ Bitcoin’s pervasiveness as collateral is giving innovative start-ups ideas brining more utility:

Milo milocredit.com, a US-based lender is offering bitcoin-backed mortgages with no downpayment, no credit requirement, no DTI, no bank statements, and 100% financing.

7/ At the other end of the scale we have #Tesla and #Microstrategy stacking sats:

8/ And more recently @stablekwon announced a plan to derisk a "death spiral" scenario for UST buy purchasing a back stop of $10 billion in Bitcoin

9/ In summary then, Bitcoin is becoming widely utilised as collateral and will be continued to use as such due to it's supply constrained nature.

This isn't Lindy, but utility.

Part 2: DeFi is broken, intermediated and poses systemic risk.

Is DeFi broken? Is the whole of Web3 a scam? Let's find out...

We had Part 1️⃣ looking at Bitcoin yesterday, Part 🥈 on DeFi below

1/ The TL;DR of John's tweet:

Defi, a system of inefficient, intermediated, infrastructural protocols which "all undermine financial stability, creating systemic and bank run risk while exacerbating issues of procyclicality and destabilization"

Oof.

2/ Tackling this one by one let’s look at energy consumption.

The most written about area on this is Bitcoin’s Proof of Work however that is still 3x less than todays banking system as @MilesDeutscher points out:

3/ Most DeFi happens on Ethereum which is also a Proof of Work system.

"Ethereum's PoW protocol currently has a total annualized power consumption approximately equal to that of Finland and carbon footprint similar to Switzerland"

Which isn't great..

4/ #Ethereum though is transitioning to Proof of Stake as part of it’s v2.0 upgrade and it is estimated that it’s energy usage will decrease by ~99.95%

To visualise what each transaction costs then Ethereum drew this comparison:

5/ Another comparison: Visa is a global payments giant.

The Ethereum team did the maths and showed $ETH's beacon chain (PoS enabled) uses ~0.4% of the energy for the same number of transactions as Visa.

Somehow I don't think we'll be banning Visa...

6/ The illusion of DeFi being free of intermediaries is somewhat true.

To get your money in/out you have to go through various software services, some of which take a cut.

7/ A 2021 paper from the Wharton showed DeFi vs TradFi designs e.g. below, and concluded:

"[DeFi] remains immature, with a variety of unresolved economic, technical, operational, and public policy issues"

So we have some work to do..

8/ That's not to say we don't have examples of where crypto tech will immensely improve people's lives and cut fees as @Cov_duk showed:

7/ Next up we have:

It's no secret that Ethereum has been struggling with the demand however the v2.0 upgrade should expand the capacity of the network.

8/ Also there are alternative chains to Ethereum that could provide the solution to high gas fees @gassssxyz

8b/ I wrote a mega-thread about FTM if you would like to learn more about (imo) one of the most undervalued L1s

9/ In terms of bugs/hacks, cryptosec.info/defi-hacks/ states as of today, there are a total of 84 DeFi exploits that have occurred.

With lost funds amounting to a total of approximately $2.4 billion at the time of these exploits.

Ethereum leads with 53 hacks. Not a great record.

10/ On software forks - not sure if this is supposed to be a bad thing, but what it enables is composability.

This is the idea that later developers can pick up the code and "snap" it into place alongside new code like lego.

More in @packyM's article:

11/ This next tweet seems to be a straight reference to the BIS's quarterly report (https://www.bis.org/publ/qtrpdf/r_qt2112b.htm)

12/ A lot of these issues are being worked on with new mechanisms being implemented, educational materials constantly improving and back stops being shored up (in the case of Terra's $10b Bitcoin purchase)

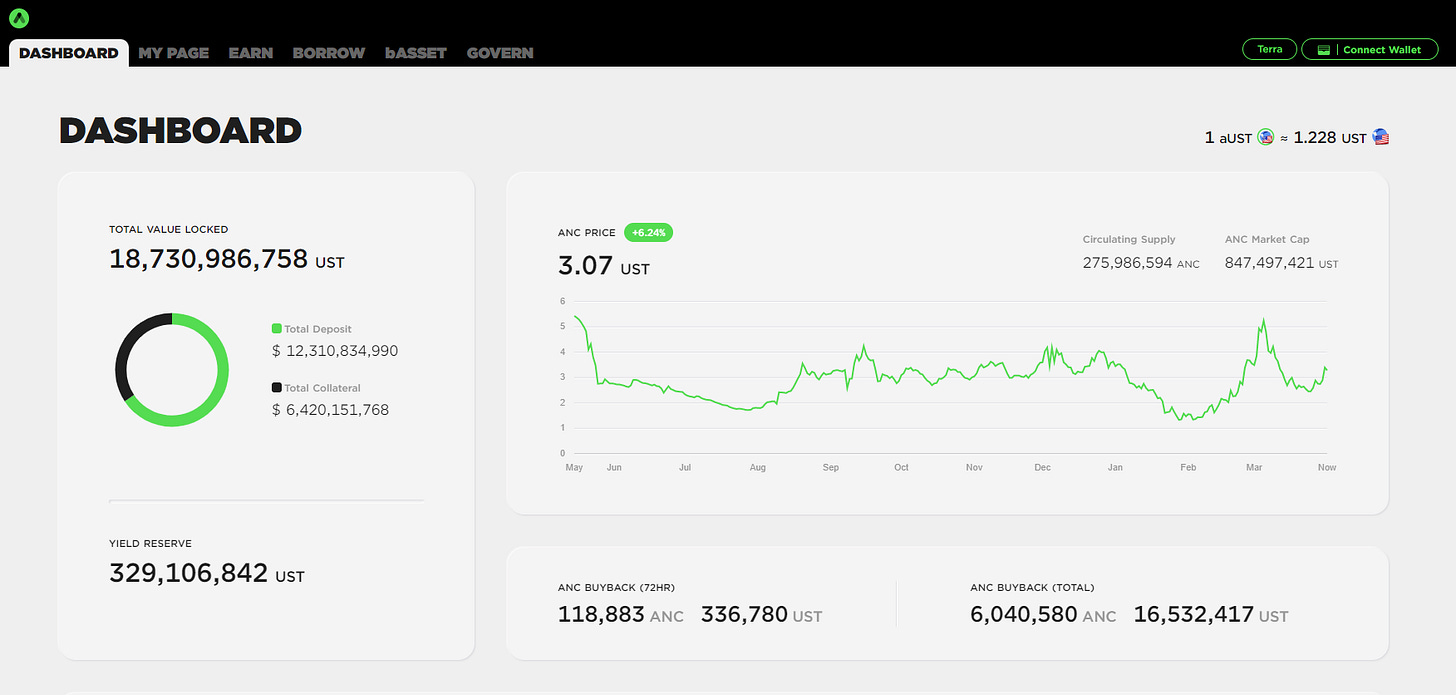

13/ One big counter is DeFi is very transparent with a lot of protocols opting for fairly standard reporting tools (thanks to composability).

Here is the @anchor_protocol dashboard as an example:

If you wanted to can even dig into L1 transactions easily.

14/ This thread is timely as we have just seen the Neutrino USD $USDN by @wavesprotocol lose it's dollar peg.

The ramifications from this are unclear but it will shake the market. One to keep an eye on.

15/ In summary, DeFi is a young burgeoning ecosystem which has massive potential (see image).

Risks need to be address and I am sure more unpredictable events will come to pass.

That shouldn't mean we need to shut it down, but work to make it better.

Bonus, I am not a DeFi aficionado so here are some accounts worth following from different ecosystems: @thedefiedge, @DeFi_Dad, @Route2FI,@SmallCapScience, @rebel_defi, @wolf_of_defi, @JackNiewold

Part 3: Web3 is a lie

Web3 is a cake.

The cake is a big fat lie.

And filled with poo.

~ My Haiku summarising this thread:

2/ Today we're continuing to look at whether the whole of Web3 a scam. We've had Part 1️⃣ & 2️⃣ covering Bitcoin & DeFi... Today Part 🥉 on Web3 accountability and protections below.

TL;DR is we're early but very aware of the issues

3/ The next part of JRS's thread focusses on the lack of accountability and protections in Web3.

Most people will agree on there needs to be greater regulations and the industry as a whole is striving to become more transparent...

4/ “there is not a single serious person in web3 or crypto or whatever you want to call it who doesn’t believe that it should be regulated”

5/ A16Z, the juggernaut VC of the Web3 world, has dedicated vast resources to helping make policies to protect consumers as per it’s website

6/ As with yesterday's thread, the issue of scalability will be solved with time. Ethereum's move to PoS is a great example of this.

We also have numerous chains offering scalable solutions like Harmony $ONE, Near Protocol $NEAR and Flare Networks $FLR

7/ Exit scams and rug pulls require education to battle. You can protect yourself following tips in this thread. Shout out to @thedefiedge for this:

8/ Unfortunately bugs are inherent and to be expected when coding, however software is an iterative process so these can and will be fixed.

9/ Here are the facts on illegal activites:

• Research shows that illicit activity accounts for less than 1% of transactions.

• From 2017 to 2020, criminal economic activity was overwhelmingly conducted through traditional financial institutions

10/ The UN estimates that ~$1.6-4 trillion in cash is laundered each year

Or from another source

So for criminals cash is still king..

Part 4: Tracking crypto is impossible

1/ Are crypto transactions easy to track? Is the whole of Web3 a scam fuelled by criminals to get laundered money in/out of different jurisdictions?

We've had Part 1️⃣ & 2️⃣ & 3️⃣ covering Bitcoin, DeFi and Web3... Today Part 4️⃣ on tracking crypto transactions below.

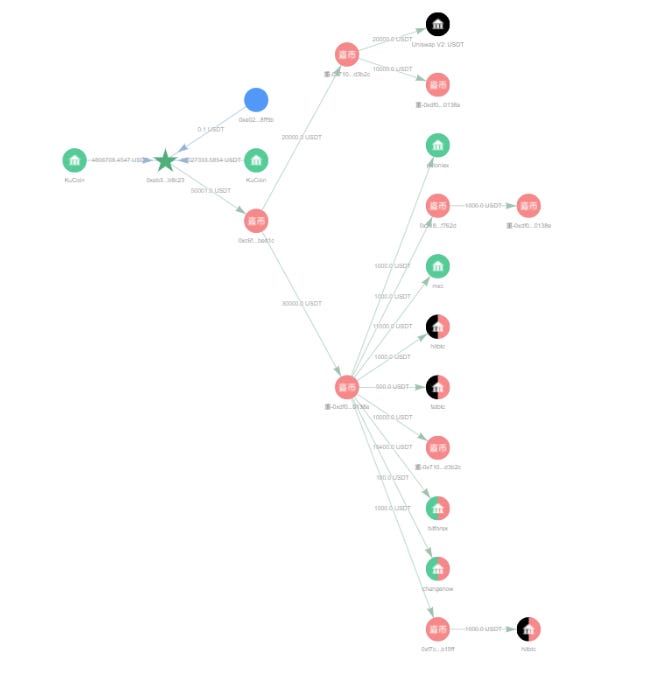

2/ Tracking crypto transactions - anyone can see all the transactions on chains with public ledgers at any time via explorers and other tools.

3/ The identities of the start/end points are really (imo) what JRS is talking about - and yes this does require specialist software

4/ Luckily though we have firms like @elliptic providing us with the tools we need to simplify tracking.

Their recent article shows how they were able to track the ronin hack to 3 exchanges - the accounts for which are frozen now afaik

5/ On top of this we saw Colonial pipeline recover 85% of their stolen funds thanks to crypto tracing services

6/ There is a lot of talk around the difficulty of tracing privacy focussed coins like Monero - so much so the IRS offered a $625k bounty for someone to crack it... the result of which I can't find.

7/ Apart from privacy coins there are also obfuscation methods.

KuCoin suffered a $270M hack the funds depositied in Tornado cash to obscure the hackers identity.

All hope is lost right?

8/ Not quite... another ingenious solution has popped up to solve this

While not perfect - $240M recovered is still short $30M, it shows that the "good" tools are getting better...

9/ I cannot deny that these tools will take a huge amount of time and effort to build, test and learn to use for law enforcement.

But the tools are there and get better / faster / easier and will continue to improve.

10/ Of course tracing is step 1, you then have the case to put together and to get it through courts - that's if you are lucky and the target falls inside your jurisdiction.

But is this any harder than tracing cash?

Someone else has asked questions too:

I'm no expert so will leave that to someone else to judge...

Part 5: So Is Web3 a scam?

1/ Is the whole crypto community rigged to empower criminals who can launder money without fear of retribution?

2/ Over the past 4 days we've had a look at @johnreedstark's comments on crypto (links at the end).

So far we've seen both strength and weaknesses in some of the arguments he's made.

Today we round off with part 5️⃣...

3/ 1st tweet back to use cases...

We can send money instantly around the world for a fraction a cent via $XRP or $XLM rather than waiting days for remittances which can save billions a year in cost to low income families seems to not count...🤷♂️

4/ It is no secret that NFT marketplaces are having massive issues with fakes and plagiarism - so much so that Cent (the ones who sold Jack's first tweet) shut down

5/ On top of this we have activities such as wash trading inflating prices massively.

But, tools are coming to prevent this - similar to tracking transactions last time, we can already monitor "seller financed" wallets as this graph shows.

It is a game of cat and mouse though.

6/ AFAIK this refers to illegal mining operations that have been springing up and sapping power from local energy grids

This is obviously bad, and why newer consensus algorithms have become the standard removing the need for more mining power

7/ One thing we didn't touch on is how Bitcoin incentivises green energy as well.

If you can use a solar panel or hydro to power your rig your variable cost basis effectively goes to zero = more profit.

This could expedite a green power revolution.

8/ See tweet 6.

9/ Again we touched on this previously. Crypto wants and needs regulation.

The internet was equally scary back in the 90s. We will find a way to make regulation work.

10/ The idea of big crypto is an interesting one.

There is a staggering amount of cash now locked into the space which imo flies in the face of Satoshi's original vision.

The nature of start-up funding is tilted in this way.

11/ IMO progressive decentralisation - something @a16z promotes, where you get product market fit then exit to the community.

This should lead us to the egalitarian state crypto promotes where users are the drivers.

Will we make it? Your guess is as good as mine.

That brings us to the end of our analysis of John's tweets.

Hopefully it has given you an idea of both the good and bad side of crypto and where we need to improve.

Let me know what you thought of this compilation of tweets below :)