Terra ($LUNA): A Full Protocol Analysis

Terra is a burgeoning ecosystem, attracting talent and money at an incredible rate, but what's behind the interest?

Welcome to the 26 newly minted Altcoin Evolutionists who have joined us since last post!

📺 Don’t like to read? Get the video version of this essay on YouTube

📝 Short form thread on Twitter

Hi internet frens👋 ,

Thanks for the help getting to 1000 total subscribers and followers across Twitter, YouTube and Substack! I have been running a YouTube channel for a while but feel like I’ve finally found something that works well with these three platforms so here’s to hitting 10k subscribers on this newsletter in 2022.

As I said in my last post, the most interesting part of Terra for me is it's native tokenomics which have been pushed to breaking point through the recent sell off and have seemed to withstand very well.

So I am excited to dive into that much more fully today…

Will Terra rocket to the moon?

As always this is not investment advice… DYOR

2021 was a breakout year for many alt L1s, none more so than Terra which blasted it’s way to second position in Total Value Locked (TVL) of any chain and it’s stable coin UST flipped DAI to take the number 4 spot.

If anything this trend is accelerating in the beginning of this year (recent events excluded) so Terra is definitely something we should be looking at.

So to give you a headstart, we’ll go deep on Terra, covering:

The origins of the protocol

The problem it is trying to tackle and what solutions it is bringing to market

Who are the investors and how do the Tokenomics work

How resistant the network is to attack?

What the developer experience is like

User growth and utility

Team and Future Governance

Video version:

L1 Analysis Framework Refresher

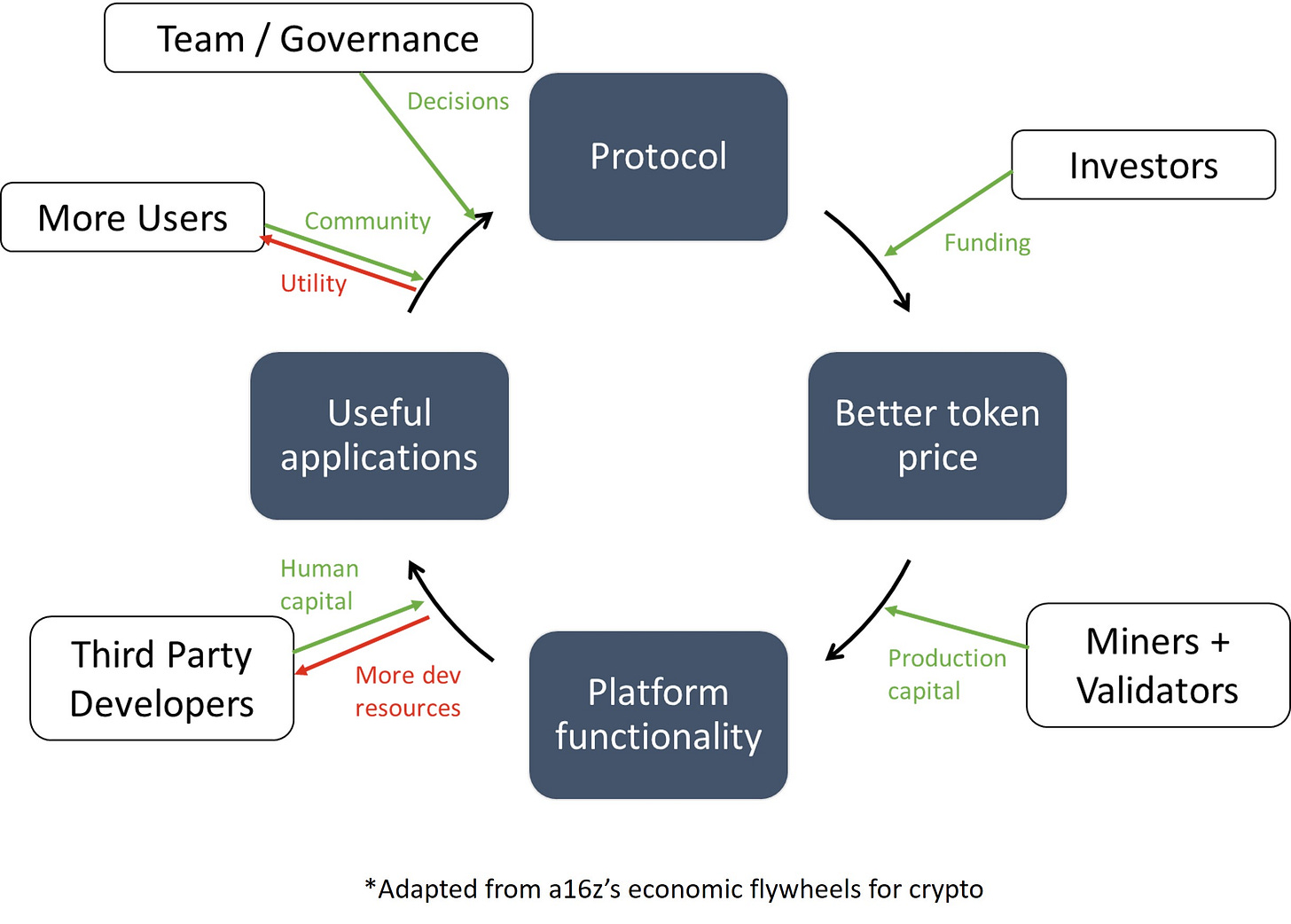

As a quick reminder on how we do these analyses; for any L1 technology I adapted a16z’s economic flywheels for crypto framework as shown below:

In principle, what happens here is the team designs, the protocol they input the decisions and stuff, the protocol attracts funding via investors and they give liquidity to the network, which gives a protocol its initial token price. Miners and validators are then attracted to supporting the network because of incentives (tokenomics) which improves the platform functionality because we're now validating blocks.

We now have a working blockchain with nothing being built on it so we turn to developers and try to incentivize them (via resources, grants etc) to build on the blockchain. They put human capital into building DApps and other useful stuff that people want to use attracting users onto the blockchain. These users form the community and eventually help govern the system.

1. Protocol

Terra is a smart contract enabled blockchain that has stablecoin functionality natively built into the ecosystem. While Terra is not strictly an L1, as it is built on top of Cosmos ($ATOM), it behaves like an L1 with it’s unique tokenomics, dApp ecosystem and validators.

As per the Terra documentation, the protocol consists of two main tokens, Terra and Luna.

Terra: Stablecoins that track the price of fiat currencies. Users mint new Terra by burning Luna. Stablecoins are named for their fiat counterparts. For example, the base Terra stablecoin tracks the price of the IMF’s SDR, named TerraSDR, or SDT. Other stablecoin denominations include TerraUSD or UST, and TerraKRW or KRT. All Terra denominations exist in the same pool.

Luna: The Terra protocol’s native staking token that absorbs the price volatility of Terra. Luna is used for governance and in mining. Users stake Luna to validators who record and verify transactions on the blockchain in exchange for rewards from transaction fees. The more Terra is used, the more Luna is worth.

a) A global vision for the future

In terms of vision for the token Messari offered this explanation of why Terra was founded:

"Terra was created in January 2018 with the singular vision of facilitating the mass adoption of cryptocurrencies by creating digitally native assets that are price-stable against the world's major fiat currencies.”

Source: Messari

AFAIK the primary reason for this focus was that the team had a wealth of experience in e-commerce and so was looking to leverage this in their next project.

There are three key problems Terra tackles:

Mass adoption of crypto - volatility poses the greatest barrier to using cryptocurrencies as everyday payments

Centralisation of stablecoins - USDT/C/P all require a level of centralisation to function which poses a risk of human interference / censorship to the crypto market

Interoperability - in a multichain future, having an open financial infrastructure will hugely benefit dApp builders and L1 chains alike (I’ll cove how Terra is doing in this regard in the “User Experience & Usage” section below)

b) Stablecoins within Terra

UST, the most famous Terra stable coin, plays a critical role in the ecosystem and works in the following way:

The key takeaway from this section is that UST and LUNA are built to compliment one another as follows:

To summarize Terra LUNA and UST, UST represents $1. To mint UST, an equal value amount of LUNA requires burning. For example, to mint $58 of UST requires the burn of 1 LUNA at today’s price. Additionally, a UST burn mints LUNA; the mint/burn feature works both ways. Therefore, when UST’s market cap increases, the circulating supply of LUNA decreases. Increasing volume in UST creates value for LUNA holders.

Source: Coinmonks

We’ll come back to how UST is performing vs other stablecoins in the User Experience section.

c) Summary

As above the main use case for Terra was envisioned to be e-commerce and as far as the technology goes I think the protocol has been designed well with this in mind.

2. Investment and Tokenomics

a) Initial Token allocation

In order to finance the development of the Terra Project, Terraform Labs held the following token sales:

Pre-seed May 2018: 10 cents per Luna, $10M raised, number of tokens is unknown

Seed-sale Oct 2018: 16 cents per Luna, sold ~192M tokens, lockup 10 - 18 months, with 30% early liquidity.

Private-sale: 80 cents per Luna, sold ~18M tokens. Lockup 3 months, with 6 months linear vest thereafter.

Representing 26% of the initial genesis block, those allocations today would be up a grand total of approx. 380x from seed and 76x from the private sale today… not bad really…

The remaining allocation was split as so:

And uses as per the following:

Terraform Labs (10%): Used to facilitate the research & development of the Terra Project. can be found in the accounts/terraform-labs directory. Terraform Labs also holds an additional 4.5% of the LUNA supply on behalf of investors who did not clear KYC in time for their token sale, and thus manually claim tokens for Terraform Labs rather than having their tokens programmatically vest from the genesis block.

Employees & Contributor Pool (20%): Used to compensate employees and contributors of the project. Some part of the coins have already been granted, and can be found in the accounts/employees directory. Currently 4.7% of this pool has been granted.

Terra Alliance (20%): The Terra Alliance is key to driving early adoption and usage for Terra. We will be using this pool to set incentives, mainly marketing discount programs (such as coupons for users) and volume incentives for alliance partners. Terraform Labs will be playing custodian for this pool, taking input from the community to best allocate resources from this pool.

Stability Reserves (20%): Bootstrapping stablecoins is no easy feat, with threats to the peg coming from every adversarial angle. Stability reserves will be to manage the network's early stability close to genesis.

Genesis liquidity (4%): 4% of Luna will be made available to the market close to genesis to allow everyday users to use and interact with it.Source: Messari

b) Tokenomics

Terra is a Delegated Proof of Stake (DPoS) protocol (covered more in section 3) and therefore requires staking to secure the network. This however is just one of the 4 mechanisms that effect the token price, the full set being:

Staking to validate blocks on the network

Staking to provide price feeds

Keeping stablecoins stable i.e. pegged to the respective fiat currency

Transaction fees

The following diagram shows how the tokenomics works:

b.i) Staking

Staking on Terra has the following rewards and risk factors:

The return on staking is currently calculated to be 10.26% per year.

Before staking it is worth noting that there is a long 21 day unbonding period (the length of time it takes to de-stake your tokens until you can use them again).

b.ii) Stablecoin Peg

The network has many stablecoins pegged to different fiat currencies. These stablecoins can be used to make payments.

As stated above Luna is burned when a stablecoin e.g. UST is minted and vice versa and represents the main driver of demand/supply in the ecosystem.

Whenever there is high demand for UST, the protocol market maker offers an arbitrage opportunity through minting Terra. The demand will lead to an increase in the price of UST in the market and it will lose its peg to US Dollar. Arbitrageurs can now trade in Luna for Terra 1:1, allowing them to sell the newly minted UST for a profit at the above-peg market price. Luna on the other hand is burned.

Source: Medium

This has the effect of reducing the supply of Luna driving the price higher. So far the ecosystem has been in expansion mode with the UST supply growing rapidly.

One question that follows this is what happens when the demand for UST is lower?Well the UST/Luna mechanism has proven to be quite resilient, even in periods of mass volatility:

In addition it seems that Terra have capital controls in place to ensure the rate of withdrawal isn’t too severe:

With lots of demand for stablecoins to protect peoples tendies the following stats from @alpha_pls show why Luna could be a hedge against a bear market:

However, in Dec 2020 we saw a UST low of $0.7929 (-25.52%) plus UST could still succumb to a bank run effect as outlined here:

This post caused a fair amount of discussion within the community eventually leading to this from Do Kwon:

Therefore, scenario seems unlikely to happen, having survived the May crash when the above was written and more recently showing strength in the face of another larger sell off. Adding in the increasing demand from the explosion of dApps on Terra and user adoption growing fast (see section 5) the Terra ecosystem has solid foundations.

b.iii) Transaction fees

Terra currently has a transaction fee of ~0.6%, which are given to validators as a reward, on stable coin payments. With industry standards around 2% for credit card processing at the point of sale it is easy to see why Terra’s payment offering is enticing.

c) Changes to Tokenomics: Columbus 5 Upgrade

In 2021 Terra upgraded the network to Columbus 5 which saw a number of changes most importantly, whereas in Columbus-4 a portion of all LUNA burned to issue UST was redirected to LUNA stakers, as well as a community pool to fund general ecosystem initiatives, Columbus-5 saw this redirect removed and replaced with a burn mechanism.

The reasoning behind this is two fold:

The emergence of Terraform Capital and the $150 million Ecosystem Fund, has reduced the need for community funded projects.

The change puts more deflationary pressure on LUNA much like Ethereum’s EIP-1559 upgrade.

d) Summary

The tokenomics are a strong driver of the growth in the Luna token price, early investors into the ecosystem have seen a tremendous return on their capital already and are likely to see greater multiples as Terra’s UST grows in prominence.

3. Consensus / Validators

a) Overview of consensus mechanism

Terra relies on a Tendermint (a byzantine fault tolerant algorithm) derived Delegated Proof of Stake (DPoS) system to secure the network.

In a Delegated Proof-of-Stake (DPoS) system, participants still stake coins. However, rather than becoming responsible for validation themselves, stakeholders outsource that work to a delegate — groups of which are then responsible for reaching consensus between themselves.

b) Advantages of consensus protocol chosen

The main advantages are two fold: 1. Speed 2. Scalability.

Tendermint is fast:

The underlying Terra blockchain technology allows up to 10,000 transactions per second (TPS) and with a transaction time of 2 seconds.

Source: 21shares

I couldn’t find details on Time to Finality specifically for Terra, however most Byzantine Fault Tolerant algorithms are near instant.

DPoS is generally considered to be far more scalable than other schemes as it requires less validators and therefore each block on the blockchain can handle more transactions. Many blockchain projects such as Cosmos, Lisk, and others adopted DPoS for this reason.

c) Disadvantages

Generally DPoS = more centralisation and there are two main ways to look at this: the Nakamoto Coefficeint and, as a measure, the number of votes the top 10 delegators have.

The Nakamoto Coefficient represents the number of validators (nodes) that would have to collude together to successfully slow down or block any respective blockchain from functioning properly.

The higher the Nakamoto Coefficient relative to the total number of validators, the lower the risk of collusion disrupting a decentralized blockchain.

As you can see Terra ranks low in terms of resistance to collusion between validators.

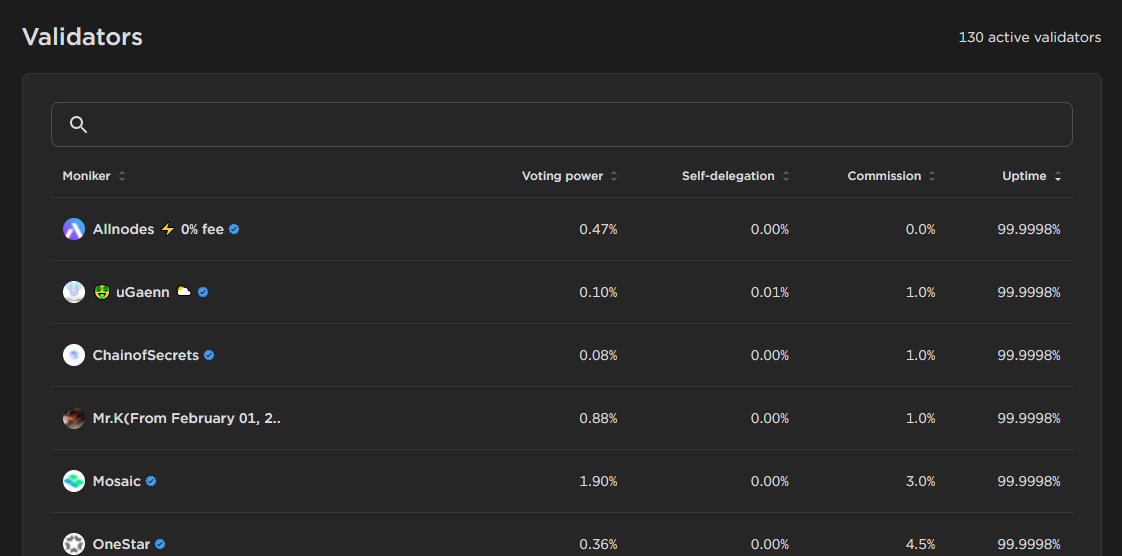

Secondly, with 130 active validators, and the top one @allnodes only having 0.47% of voting power the level of decentralisation is ok.

Compared to other platforms this is more concentrated (due in part to the smaller number of validators)

Over time this list is expected to increase to 300 validators which will help to counteract some of the disadvantages, however relative to where AVAX and SOL are now that still seems small.

Filling in our L1 Analysis

As we are halfway through let’s jump back and fill in our L1 Analysis:

Onwards now to dApps, usage and team to round off this protocol deep dive!

4. Developer Experience

Terra has a maturing developer ecosystem with extensive documentation, tooling and grant programs to foster innovations on the chain.

The Generalist took a look at the number of individual contributors and code commits over the past year:

The trend is good however they note that Solana boats 7.5x the number of code commits in the same time.

Guiding the overall development experience and education within the ecosystem is the newly created Luna Foundation Guard.

Terraform Labs has donated a whopping 50M Luna ~$4b to this new foundation as Do Kwon stated here:

This outstrips a lot of other L1 funds like Nears relatively small (now) $1b grant program.

In addition to the grants program, the Terra ecosystem benefits from deep ties to three funds:

Terrafrom Labs which raised $150m to help nurture the ecosystem

Another $50-million fund was launched by Hong Kong venture capital firm Chiron Partners in December 2021

Also, Delphi Labs, part of Delphi Digital, which has invested heavily into incubating projects on Terra.

In short the Terra ecosystem has a huge amount of resources and know-how to take teams from 0 to 1 quickly and effectively.

5. User Experience & Usage

a) Useful applications

The user experience within Terra is improving daily with a wide variety of applications to choose from, as shown by this ecosystem list:

Lending & Borrowing - @anchor_protocol, @mars_protocol, @orion_money

Launchpad - @StarTerra_io, @pylon_protocol

Investment - @mirror_protocol, @prism_protocol, @Levana_protocol

Insurance - @NexusMutual

Wallet - #TerraStation, @Mirror_Wallet

Bridge - @wormholecrypto, @cosmosibc

Payments - @alice_finance, @kashdefi

NFTs marketplace - @knowhere_art

Community - @TerraLUNADaily, @Terrians_

Analytics Tool - @flipsidecrypto, @LunarCRUSH, @DefiLlama

Much longer list here:

I did a full deep dive into many projects here if you want to go deeper on some of the stand out projects:

a.i) dApp Highlight: Anchor Protocol

One dApp of particular importance to the ecosystem is Anchor Protocol. It forms one of the three crucial “money lego” pillars Terra is built on:

I went through a lot of stats in my last post about how great Anchor is, recently however it has had some issues with it’s reserves as depositors have piled in, but borrowers haven’t increased at the same time to provide funding for the yields.

The effect has been that the reserve Anchor has (in case of this scenario occurring) has been depleted alarmingly fast ~$1.5m daily over that past month. More detailed analysis can be found in this great thread:

The TL;DR from the above is not to worry. A cash infusion from Terraform Labs will likely solve the immediate issue (according to this model ~$480m will be required although where the money will come from is still an unknown), and mainatin the high interest rates people are receiving. In the long run falling rates will help Anchor to become more sustainable.

b) Ecosystem Usage Statistics

b.i) UST growth

As stated above UST is key to the ecosystem, so Terra’s success will largely depend on the adoption of UST as a standard stablecoin. Luckily we have some data that shows how well they are doing, firstly UST supply:

As we can see the growth in UST has been exponential since November time. The reuslt of which is the UST flipped DAI as 4th largest stablecoin:

How will this look in the future... I dug out a couple of predictions, first Delphi Digitals data:

To give a longer term view:

Our projections show there will be $177B in new Terra stablecoins by the end of 2025. Therefore, $177B worth of LUNA tokens will have to be bought and burnt to mint $177B worth of stablecoins. In other words, the LUNA supply will decrease and there will be enormous buying pressure as the demand for Terra’s stablecoins increases. This will inherently drive the price higher. The yield accrues to anyone holding LUNA tokens and not just to LUNA stakers.

Source: @DavidRakusan of @RBF_cap, Rockaway Blockchain Fund

It’s interesting to note that $177b new UST issued would overtake the current marketcaps for both USDC and USDT combined…

b.ii) DeFi TVL

As mentioned in the introduction 2021 saw Terra take second position in Total Value Locked (TVL) - a widely accepted proxy for usage, second only to Ethereum (which still dominates with 60% market share).

The trend however is not good for Ethereum (as JPM pointed out too) which in August 2020 accounted for 95% of TVL… Terra has been one of the many chains to erode away at this dominance as the following graph shows.

b.iii) Onchain data analysis

Terra has healthy onchain data with around 0.5m daily transactions, 200k active addresses, 150 active dapps and a reasonable amount of development activity.

While not the top of the list across the board, the fact that it has rapidly taken the number 4 spot for DeFi TVL will no doubt draw more interest from developers and teams looking for L1’s to build on.

c) Future Growth - Prepared for a multichain future

Due to Terra’s foundation on the Cosmos blockchain there is a large unlock waiting to happen for this ecosystem.

While Terra currently sits in 5th UST and LUNA have a combined liquidity of nearly $200m on Osmosis (the gateway to Cosmos ecosystem).

Terra’s importance to Cosmos can be highlighted when looking at volume via Osmosis in which the combined 24h amounts are second only to the Osmosis token itself.

Therefore as Cosmos, via it’s IBC, opens up new assets we are likely to see even greater demand for the Terra tokens.

In addition to the IBC integration in October 21 we also saw Wormhole compatibility when the Columbus 5 upgrade was launched:

The cross-chain bridge will enable Terra-native assets like UST and LUNA to be transferred to Solana, Ethereum, and Binance Smart Chain through one interface.

Source: Crypto Briefing

These developments demonstrate the benefits in building an open infrastructure and we will see if Terra can benefit from this over the long run.

More details on the impact of the Columbus 5 upgrades to interoperability can be found in this excellent thread

6. Team and future governance

a) Terraform Labs

Terraform Labs is a South Korean-based company established by Do Kwon & Daniel Shin in 2018. The company had a $32 million from crypto-giants such as Binance, Arrington XRP and Polychain Capital, as well as assembling an alliance of commerce partners including Korean ticketing giant Ticketmonster and travel service Yanolja.

Key team members:

Do Kwon (CEO)

Founder and ex-CEO of Anify.

Stanford University Alumni

Daniel Shin (COO of Terra, CEO of CHAI)

Serial entrepreneur for 9 years

Founded TMON e-commerce business with $3,5bn revenue.

Past experience at McKinsey and JPMorgan Chase

b) Governance

The Terra protocol is governed by community members. Community members and validators submit, vote, and implement proposals.

There are 5 potential proposal types: Text Proposals, Parameter Change Proposals, Community Pool Spend Proposals, Tax Rate/Reward Weight Update Proposals, and Software Upgrade Proposals. You can read more here.

Completed L1 Analysis

This brings us to the end of our analysis part now we put it all together for the Bear and the Bull Cases for Terra ($Luna).

The future of Terra

🐂 Bull Case

UST becomes number one stablecoin either due to the collapse of centralised alternatives, demand from the ecosystem e.g. IBC and Wormhole open up massive inflows capital and assets, eclipsing USDT and USDC combined (requiring ~117b UST to be created), or explosive growth in dApps on the payments network.

These events cause a mass burning of Luna driving the price to a projected $170 range, a ~3x from today.

🐻 Bear case / headwinds

The main risk to any algorithmic stablecoin is the failure to keep it’s peg. While UST held up well in this last drop, will it hold up in a massive fall? Modelling by TFL says no, but we shall see

Further to the previous point Terra’s stability mechanism works well when Terra’s economy is expanding – however, it remains to be seen how the whole system behaves during contractionary. So far we only have modelling, but real-world data hasn’t been collected.

The other elephant in the room is regulation… Terraform Labs is currently in a battle with the SEC over Mirror Protocol. To counter this Terraform Labs isn’t a US company so the SEC is limited in it’s options, plus Terra has already counter sued. Time will tell on this one.

A lot of the current growth can be placed in part to the high yields offered by Anchor. As rates fall (especially with the issues around Anchor’s yield reserves) will users still be attracted to the protocol?

Competition is fierce and comes in a few forms:

Battling to reduce Ethereums market share will be hard and Terra has significant ground to cover to catch up with leading DeFi chains

The same goes for catching up and eclipsing Tether’s USDT, currently the most popular stablecoin.

Also there are businesses risks around the dApps, Chai for example could still become irrelevant as bigger players integrate crypto rails and reduce fees.

Finally, decentralization may play a role as Terra is less decentralized than other networks with only 130 validators.

Summary

Overall, Terra ($LUNA) has one of the most promising ecosystems I have seen, with strong backers, tokenomics that lend itself to resilience.

So there we have it. As always DYOR this is not investment advice, also I might have missed stuff that is a key technology thing that you may understand better than I do.

Hope you enjoyed this deep dive into Terra, I will be talking about it a lot more on Twitter. So if you follow me there @0xGregH that will give you the latest.

If you liked this content, please give us a share and tag me!

Video version:

Subscribe below for more content:

Why not addressing the real reason behind the drive for the post November 2021 use UST increase ? Abracadabra ? Curve pools ?